Stocks from banking, realty, oil and gas, power sectors have seen their average cash market turnover more than double

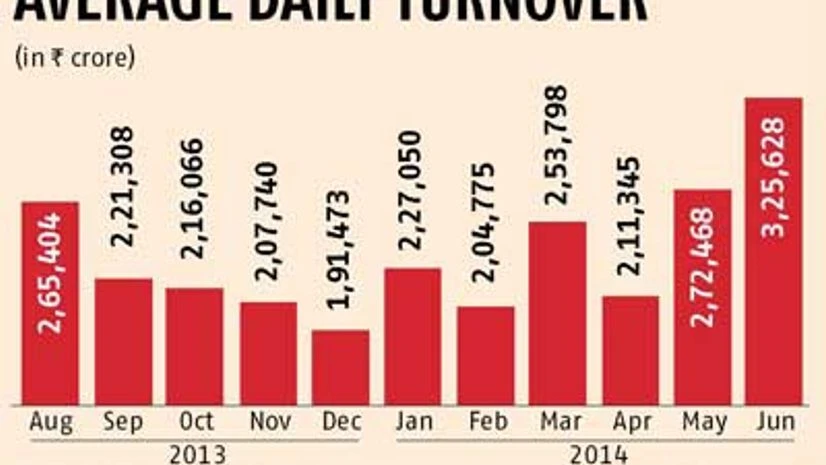

A sharp rally in equity market post the outcome of the general election has seen the total market turnover (cash and future and options segments) hit a new high in June. The combined average daily turnover in the cash and future and options (F&O) segments touched Rs 325,628 crore in June, rising nearly 32 per cent from its previous high of Rs 247,039 crore recorded in August 2013.

The up move in the equity markets since May 16 after the BJP-led National Democratic Alliance (NDA) won the elections with a comfortable majority has rekindled investor interest in the markets, analysts say. This has led to the market turnover rising sharply; especially in the cash market that has seen the turnover hit a five–year high.

Foreign institutional investors (FIIs), too, have been a reason behind this sharp rally with their net investment in Indian equities since September 2013 totalling Rs 112,860 crore ($18.5 billion). Of this, nearly Rs 27,417 crore ($4.6 billion) was invested in the past two months after the Narendra Modi-led BJP won a decisive election mandate.

“A sustained bull market always brings traders and investors back. Renewed hope that the worst is over for the economy is luring investors back to the equity market. The last five to six years have been not been too good for the markets and now the investors are returning to the market,” says Jagannadham Thunuguntla, strategist and head of research, SMC Global Securities.

Since May 16, the Sensex has gained over 1,508 points, or 6.3 per cent, to 25,414 on June 30 and made a record high of 25,725 in intra-day trade on June 11.

Banking, realty, infrastructure, oil and gas, power and metal sectors, which recorded sharp jump in their stock values, has seen more than 100 per cent rise in their average cash market turnover. Some prominent stocks that have seen a rise cash market turnover includes, Sesa Sterlite, ONGC, Reliance Capital, Unitech, Jindal Steel and Power, Coal India, Reliance Infrastructure, NTPC and Hindalco Industries.

On the other hand, the combined average daily turnover of F&O segment hit a record high of Rs 301,594 crore in June, a nearly 90 per cent jump from Rs 159,876 crore registered at the beginning of the 2014 calendar year.

“June was sandwiched between two key events – the general election results and Union Budget. We also saw some concerns on the geopolitical front. As a result, the volumes and the volatility have shot up,” said Siddarth Bhamre, head of equity derivatives and technicals, Angel Broking.

“We don’t expect the volumes to dip very significantly going ahead. Most of the participants, especially domestic, have missed out the up move. Hence on every dip, they would be looking for a buying opportunity, which in turn, could help volumes remain robust. If adequate measures are taken to revive growth, banking, oil and gas, capital goods and infrastructure sectors could remain in focus,” he adds.

)