At a time when flows from foreign institutional (FII) investors have taken the markets to new highs, domestic mutual fund managers have focused on mid- and small-cap stocks.

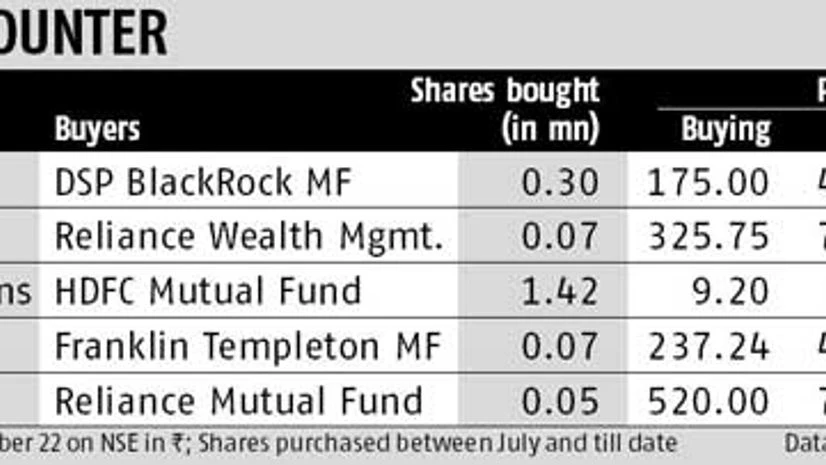

According to the National Stock Exchange (NSE) and BSE bulk deal data, fund houses such as HDFC Mutual Fund, Reliance Mutual Fund, IDFC Mutual Fund, SBI Mutual Fund and DSP BlackRock have bought shares of mid- and small-sized companies (market capitalisation of Rs 450-1,000 crore) since July this year. During this period, mutual funds, fence-sitters for most of the past year, have invested a total of Rs 12,806 crore in the markets, compared with a net FII investment of Rs 25,549 crore.

“We have expanded our investment universe by going down the market-cap club to take advantage of the opportunities in that space. Given the greater confidence in the macro-economy and the corporate environment, mid-cap companies will be the bigger beneficiaries of the uptick in the economy,” says Navneet Munot, executive director and chief investment officer, SBI Mutual Fund. “There is a large valuation gap between large-caps and mid- and small-caps. To a large extent, this has been bridged. But still, I think the trajectory of earnings growth could be higher in the case of some mid-caps,” he adds.

Kenneth Andrade, head of investments at IDFC Mutual Fund, however, says the company isn’t adopting a new strategy, as for long, it has focused on mid-caps and emerging companies.

Among individual stocks, 8K Miles Software Services, R S Software, BL Kashyap and Sons, M M Forgings, Siyaram Silk Mills, Gammon India and Marico Kaya Enterprises have rallied about 50 per cent each, after institutional investors and mutual funds lapped up shares of these companies from the open market.

While HDFC Mutual Fund bought shares of BL Kashyap and Sons, Gammon India and Centrum Electronics, Reliance Mutual Fund has bought shares of Siyaram Silk Mills, Atul Auto, Snowman Logistics and Sanghi Industries since.

Snowman Logistics saw its market value rise 26 per cent within a week, after Reliance Mutual Fund bought two million shares of the company at Rs 79.04 a share, on the day the company was listed.

On Friday, investment management firm Vanguard Group bought equity shares of Aurobindo Pharma, Jindal Saw, PVR and HCL Infosystems, through Van Eck Associates Corporation A/C Market Vectors-Vietnam from the open market. Data show Mellon bought into Sunteck Realty, Redington India and Indiabulls Housing Finance on NSE, through bulk deals.

Within 10 days, the stock price of BL Kashyap and Sons more than doubled to Rs 19.6, after HDFC Mutual Fund bought about a million shares of the company from the open market. 8K Miles Software Services, an internet software and services provider, has rallied 38 per cent to Rs 451 in the past three trading sessions, after Sundaram BNP Paribas Mutual Fund bought two per cent stake in the company, through the open market.

Compared to August 8 (when the stock stood at Rs 199, the scrip has appreciated about 100 per cent, following DSP Blackrock buying 303,529 shares (three per cent of the company’s total equity) at Rs 175 a share.

)