A short settlement and positive election expectations have led to spikes in option premiums. The VIX is high despite narrow-ranged trends in the spot market. The Nifty is holding out above 6,800, near historic highs. The market has moved up, driven by foreign institutional investor (FII) buying coupled to retail buying. Domestic institutions are net sellers.

The Nifty has support at 50-point intervals. It is testing resistance in 6,825-6,850 band. The wide range is relatively new territory and it is difficult to identify zones of congestion in this 500-point range.

Conventional signals don't matter in the short run. Macroeconomics will be ignored and full-year results will also have little impact till the poll is over. There are likely to be big swings on May 16 and later as the counting ends. The April settlement will probably go through with the market range trading tightly. The May and June options segment have significant open interest.

The FIIs are discounting a strong show by the Bharatiya Janata Party (BJP). A look at open interest (OI) in the May Nifty call chain shows a lot of traders are braced for a zoom till 7,500-plus. Significant OI is also there at 8,000c. There is a lot of OI in the put chain down to the May 6,000p and quite a lot of OI till 5,500p. Premiums are massive on both call and put side of the chain.

The Nifty's put-call ratio for May and June combined is 0.8 since calls far outnumber puts. This is a very overbought market: Not a surprise. Many traders are discounting possible Nifty moves of greater than 10 per cent in May.

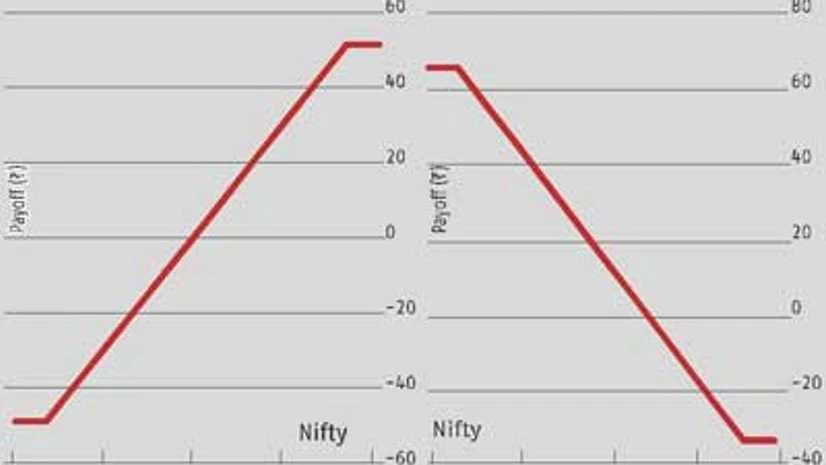

Watch the Bank Nifty and the information technology (IT) index. The Bank Nifty is high-beta and bullish. It could run up 14-15 per cent or more, if the broader market goes up 10 per cent. A deep bullspread may be worth picking up, with a long May 13,500c (488) and a short 14,000c (326). This could pay a maximum 337 for a cost of 153. A brave trader could also sell this spread and buy it back inside the next two sessions, since a drop in premium is very likely. The IT index would be a good hedge if the rupee weakens on FII selling. Given the very high premiums May options are commanding, it seems reasonable to sell options. There is normally a sharp decay in premium in the first few sessions of the new settlement and this pattern should hold. The trader could sell the May 7,000c (215), or the May 6,600p (165), or both, with the intention of buying back on April 25 or April 28. It would be prudent to cover any such sales with long 7,200c (133) and long 6,400p (108), respectively.

The risk-reward equations for bullspreads close to money are not so good. A long May 6,900c (262) and short 7,000c (214) costs 48 and pays a maximum 52. A long May 6700p (200) and a short 6,600p (165) costs 35 and pays a maximum 65, more reasonable. It may be worth waiting till Friday to exploit some time decay.

)