Pension funds and sovereign wealth funds’ holdings of Indian equity have increased by Rs 23,758 crore since the beginning of the calendar year, in anticipation of improving economic fundamentals and a stable government at the Centre.

The total assets with these two segments rose from Rs 2.18 lakh crore in December 2013 to Rs 2.42 lakh crore in the latest available data from the stock market regulator.

Both sovereign wealth funds and pension funds are seen to be relatively stable long-term investors. An increased proportion of such funds are perceived to bring greater stability to markets because they do not generally move in and out for short-term gain.

“They’ve been investing here since there is a sense that growth has bottomed out. This is seen as a good opportunity to invest in an economy where corporate performance is also likely to improve,” said Vaibhav Sanghavi, director, equities, at Ambit Investment Advisors.

Ambareesh Baliga, managing partner, global wealth management, Edelweiss Financial Services, said both categories tended to invest with a long-term perspective. “It was being anticipated that there would be a stable government, with long-term visibility, confirmed by the election results. They came in at a time where the markets provided decent upside and the risk/reward was favourable,” he said.

Sovereign and pension fund holdings as a proportion of total foreign assets has been on the rise since the start of January, going up 34 basis points to 16.69 per cent. The two categories account for nearly 17 per cent of the total funds under custody for foreign investors, according to data from the Securities and Exchange Board of India.

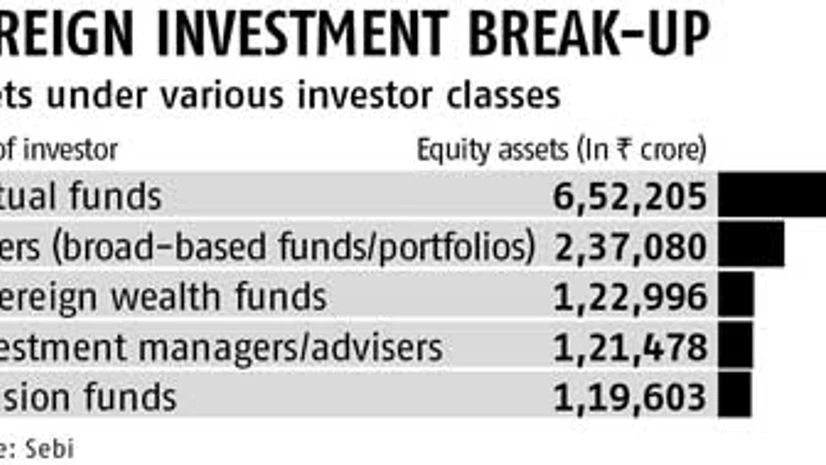

Sovereign funds account for Rs 1.22 lakh crore of the Rs 14.53 lakh crore in total foreign equity holdings. Pension funds account for Rs 1.19 lakh crore, said the figures for April.

They occupy the third and fifth spots, respectively, among the various foreign investor categories who invest in India. Only mutual funds (Rs 6.52 lakh crore), other broad-based funds (Rs 2.37 lakh crore) and funds categorised by investment managers (Rs 1.21 lakh crore) account for more holdings.

Foreign institutional investors have been net buyers in Indian equities by Rs 55,168 crore or $9.2 billion since the beginning of the calendar year. The Sensex is up 21 per cent in the same period.

“Globally, they are looking at opportunities to meet their internal return targets and India presents such an opportunity. From the Indian perspective, this money is welcome, as it is both long-term and provides a good amount of stability for the markets,” said Sanghavi.

)