The Securities Exchange Board of India (Sebi)’s drive to de-list companies facing suspension has gotten underway. The BSE on Tuesday sent ‘compulsory de-listing’ notices to 194 companies. Trading in these companies has been suspended for nearly 13 years for non-compliance of listing agreement. The promoters of these companies will soon have to pay their public shareholders a ‘fair value’, which will be calculated by an independent agency. The fair value will act as a buyback price to ensure de-listing.

According to sources, Sebi is likely to attach properties and other assets of companies that fail to comply with de-listing notices. The regulator is expected to issue a circular in this regard soon, said a source.

Sebi and exchanges have embarked on a drive to weed out thousands of companies whose shares are suspended from trading due to non-compliance. The regulator wants the public shareholders in these companies to be adequately compensated.

“The exit option will help public shareholders who have been adversely impacted by suspension of trading,” said Sandeep Parekh, founder, Finsec Law Advisors.

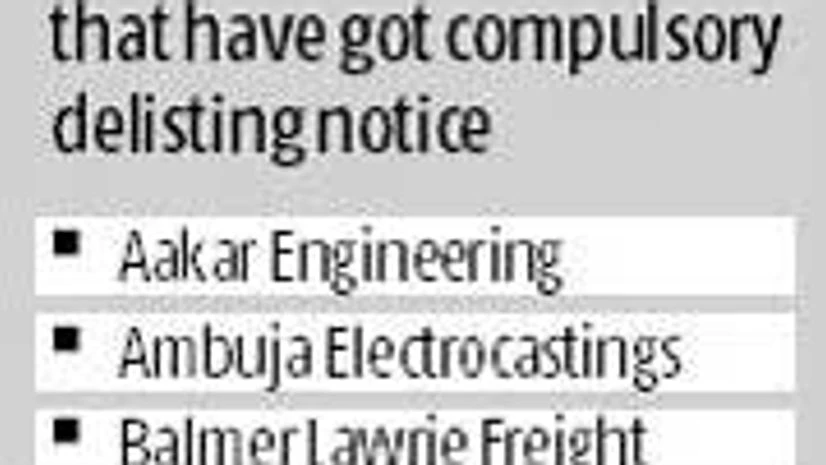

There are 1,021 companies listed on the BSE and 200 on the National Stock Exchange, which have been suspended for more than seven years in this regard. The 190-odd companies sent de-listing notices on Tuesday are the first batch identified by the BSE. In the first batch, the regulator sent notices to companies that were suspended for maximum number of years.

The BSE said in a notice that “…the de-listed company, its whole-time directors, promoters and group companies shall be debarred from accessing the securities market for a period of 10 years from the date of compulsory de-listing”.

Parekh said promoters who respond positively need to be given a fair chance and shouldn’t face stringent action.

The promoters of some of the companies that have got de-listed are said to be active in the market. They have started new business or serve on the boards of other listed companies.

Shriram Subramanian, managing director, InGovern, says the move to de-list suspended companies will help in eliminating “irrelevant and non-serious players”.

“There are several instances where promoters are never sympathetic towards minority shareholders,” he said.

In February, exchanges had sent notices to 500-plus suspended companies to either take steps towards getting their suspension revoked or face compulsory de-listing. In June, the exchanges had sent further notices asking these companies to make their representation to their ‘de-listing committee’.

)