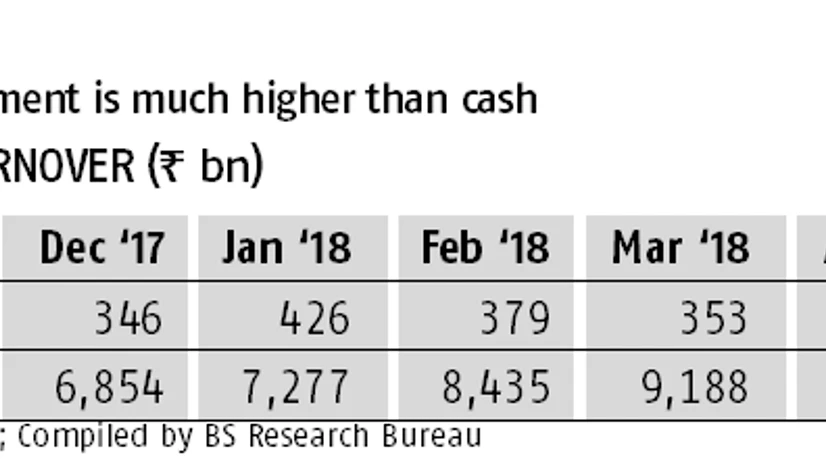

The Securities and Exchange Board of India (Sebi) intends to have tax parity in the futures and options (F&O) segment. Sebi is of the view that the differentiating tax structure, particularly the securities transaction tax (STT), is incentivising participation in the derivatives segment.

The market regulator has written to the government—which sets the tax rate for the capital market—on bringing tax parity between the cash and the derivatives segment.

Currently, a STT between 0.1 per cent and 0.125 per cent is levied on F&O transactions. Within the derivatives segment, STT on sale of options—the most-popular segment—is just 0.05 per cent

)