Shares with differential voting rights (DVRs) rallied sharply on Thursday, a day after the BSE allowed their inclusion in benchmark indices. Investors bought into DVRs, which trade at substantial discounts to their main shares, in anticipation these would make it to the main indices soon.

DVRs are similar to ordinary shares, except they offer higher dividend to investors in lieu of voting rights. Companies issue DVRs to raise capital without diluting the voting rights of promoters and existing shareholders. So far, four companies have issued DVRs in the Indian market.

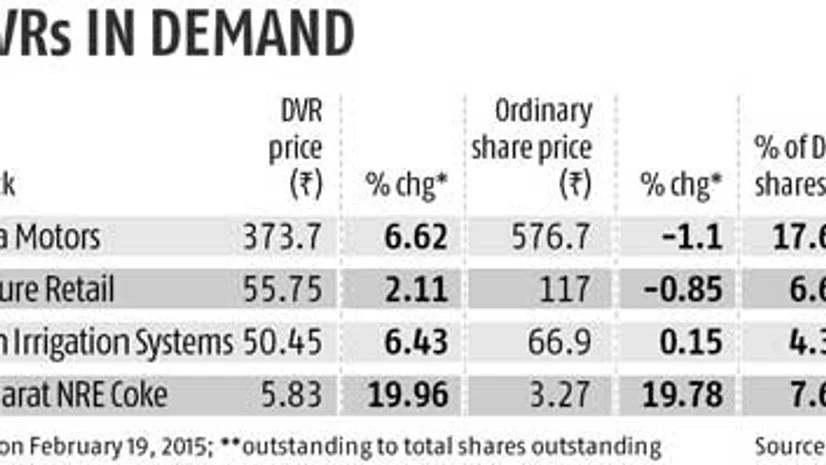

On Thursday, the DVRs of Tata Motors rose 6.6 per cent, while those of Gujarat NRE Coke, Jain Irrigation Systems and Future Retail gained 19 per cent, six per cent and two per cent, respectively. The ordinary shares of these companies either fell about one per cent or rose marginally. Gujarat NRE Coke was the only exception; its ordinary shares hit the upper circuit during Thursday's trading session.

"Because of lack of visibility, these DVRs often fall under the radar of investors. So, if these DVRs are given a berth in the main indices, it will allow for increased retail participation in these instruments," said Deven Choksey, managing director of K R Choksey Securities.

The price differential between the ordinary share and DVRs, currently 45-60 per cent, could fall in time, making these more attractive. Globally, DVRs trade at a 10-15 per cent discount to their respective ordinary shares.

Inclusion in the main indices could raise demand for DVRs, eventually reducing the price differential and boosting demand for the entire product segment, experts say.

One of the criteria for inclusion into the main indices is the DVRs outstanding of the companies concerned should account for at least 10 per cent of the total shares outstanding. As of now, only the Tata Motors DVR qualifies for inclusion, as its DVR shares outstanding are about 17 per cent of the its overall shares.

Besides, DVRs will be permitted into the index only if the ordinary share is already part of any of the S&P BSE Sensex, S&P BSE 100, S&P BSE 200 and S&P BSE 500 indices. Currently, except for Gujarat NRE Coke, all other shares of companies with DVRs are part of at least one of these.

"Companies will look at increasing their DVR holdings to be made a part of the indices. Also, issuing DVRs is a much more convenient way of raising capital without much stake dilution," said Rikesh Parikh, vice-president (equities), Motilal Oswal Securities.

Analysts believe DVRs could soon become a regular form of fund-raising for companies, especially those with lower promoter holding.

)