According to data by Delhi-based research firm OreTeam, sponge iron price dropped Rs 1,200 last month to Rs 22,600 a tonne in Mandi Gobindgarh, Punjab, market. Elsewhere in Raipur (Chhattisgarh) and Bellary (Karnataka), the steelmaking raw material is quoted at Rs 19,000 a tonne.

“Around 50 per cent of the sponge and steel industry has either become nonperforming assets or forced to go in for restructuring with banks. These units are unable to pay their debts accumulated due to the huge interest burden of the past 4-5 years. While raw materials prices have declined globally, domestic producers continued to keep price elevated resulting into continuous squeeze in margins,” said Rajeev Kapoor, president, Chhattisgarh Sponge Iron Manufacturers Association (CSIMA).

While high cost of funds has deterred investments, the working capital limits of many small-and-medium-scale companies have been squeezed, pushing the domestic sponge iron and steel industry into a precarious position. “Therefore, the public sector miner NMDC should cut iron ore prices at least by 30 per cent to bring the in line with global markets,” said Kapoor.

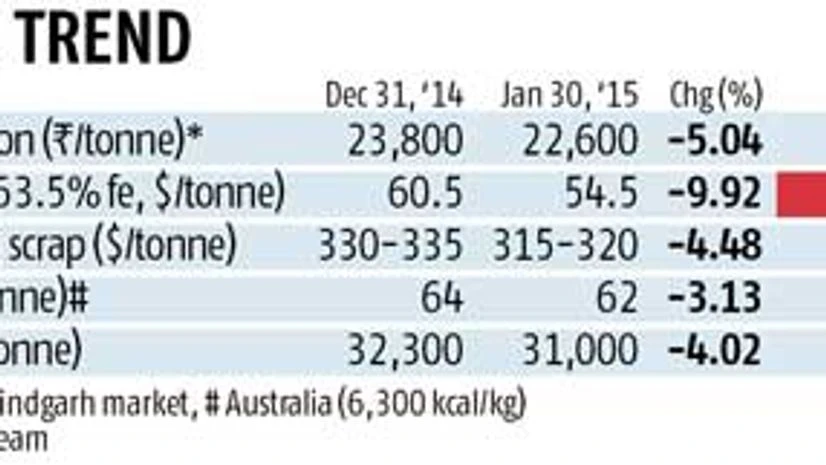

In the past three months, however, sponge iron prices have declined 10 per cent on falling raw material prices. While shredded scrap is currently quoted at $315-320 a tonne from $330-335 a tonne a month ago, coal of Australia origin is traded at $62 a tonne now from $64 on December 31, 2014. Iron ore lumps in global markets have fallen to trade currently at $54.5 a tonne on January 31, a sharp decline from $ 60.5 a month ago.

“The sponge iron price has reached the flash point from where further decline is impossible. This is the level where a bounce-back cannot be ruled out for which, however, a real demand pick in steel is needed. Unfortunately, despite all positives, the ground level demand is yet to be seen - which might be six months away,” said Amitabh Mudgal, vice-president (marketing and corporate affairs), Monnet Ispat.

The biggest problem with the sponge iron industry is elevated price of iron ore. Vijay Jhanwar, general secretary, CSIMA, said: “Of around 300 sponge iron producers across India, nearly half have captive iron ore supplies. The remaining half, however, depend on merchant iron ore. Surprisingly, iron ore producers such as NMDC have not cut prices in tune with decline in global prices, leaving producers’ margins under tremendous pressure.”

Accumulated losses, high debts and a heavy interest burden in the past four-five-years have pushed several Indian sponge iron and steel industry units to the brink of closure. Unless the government extends relief measures on a priority basis, most might turn into non-performing assets or be forced to shut shop. Out of 80 small sponge iron producers in Raipur, around 10 have already shut down.

Global iron ore prices have halved in the past year. However, NMDC has reduced iron ore prices only marginally.

)