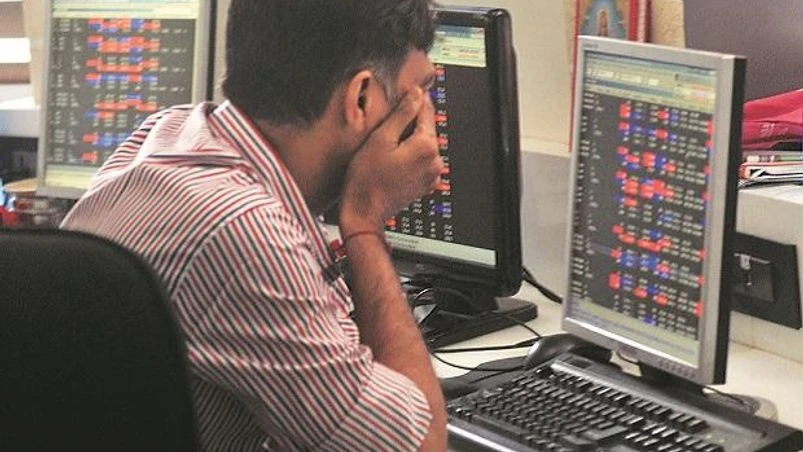

Sensex snaps 3-day winning run, sheds 317 pts; Banks, realty shares decline

CLOSING BELL: The NSE Nifty 50 slipped 92 points to settle at 17,944. L&T, Hero MotoCorp, UltraTech Cement bucked the trend, while Adani Group shares ended mixed on Friday.

)

11:20 AM

Gensol Engineering spikes 3% after it secures deal worth over Rs 501 crore

11:11 AM![]()

Widening deficit: Worries persist over FY24 current account balance

With India expected to be among the fastest growing major economies in financial year 2023-24 (FY24), officials in the Union government are not as worried about most major economic indicators like gross domestic product (GDP), inflation, and the fiscal deficit. READ MORE

10:59 AM![]()

Cement shares in focus; UltraTech, Dalmia Bharat hit 52-week highs

Most of the company managements' continue to be positive on the cement demand, led by the government’s thrust on infrastructure projects, pick-up in urban real estate, and likely recovery in the rural segment. READ MORE

10:49 AM![]()

PI Industries stock gains from CSM business and margin expansion

A strong performance in the October-December quarter (third quarter, or Q3) of 2022-23 (FY23) led to an 8 per cent jump in the stock of the country’s second-largest agrochemical player by market capitalisation — PI Industries. READ MORE

10:39 AM

![]()

Adani Green to disclose refinancing plan after fiscal year ends: Report

Adani Group had hired banks to arrange calls with bond investors after it was caught up in a short-selling storm in recent weeks.

One of its subsidiaries, Adani Green Energy Limited Restricted Group, will refinance existing bonds through a 15-year amortizing private placement, the executive said, according to the sources. READ MORE

10:27 AM![]()

With returns no better than flexi-caps, ELSS faces an uncertain future

A comparison of ELSS returns with those from similar categories, such as flexi-cap and large-cap funds, shows fund managers in recent years haven’t taken advantage of the lock-in period. In the past three years, ELSS have delivered annualised returns of 14 per cent, the same as that of flexi-cap funds. The returns are almost similar even if we look at rolling returns. Over five years, ELSS trail both large-cap and flexi-cap funds. READ MORE

10:16 AM![]()

Non-BFSI companies' net profits shrink sharply for second quarter

Corporate results for October-December 2022 (Q3FY23) suggest a sharp slowdown in economic activities in non-financial services, including manufacturing. READ MORE

10:06 AM

![]()

Medanta hits highest level since listing; stock surges 13% in 2 days

Meanwhile, for October-December quarter (Q3FY23), Medanta reported its highest-ever quarterly total income of Rs 706.2 crore; growth of 19.0 per cent year-on-year (YoY).

For first nine months (April to December) of financial year 2022-23 (9MFY23), Medanta’s consolidated total income grew 21.2 per cent year-on-year (YoY) to Rs 2,027 crore. READ MORE

9:56 AM![]()

BREAKING: Elon Musk shuts 2 of 3 Twitter offices in India, sends staff home, reports Bloomberg

9:55 AM![]()

Minda Corp, Pricol surge up to 6% amid stake sale buzz

The promoters have absolutely no intent of undertaking any secondary sale of promoter stake nor does the company have any intent to raising equity capital of any form as the company has strong financial fundamentals and healthy cash profits that will meet the needs of capital for its future growth, Pricol said on clarification of media news. READ MORE

9:44 AM![]()

Comment :: 'Sensible strategy in this volatility is to buy high quality names'

There is a clear pattern to the trends from the mother market, US. Whenever positive news like declining inflation comes, equity markets rise on hopes of a Fed pause and a possible rate cut by end 2023. Conversely, whenever data indicates a robust US economy, tight labour market and very slow disinflation, equity markets fall expecting the Fed to remain hawkish. This see-saw game is likely to continue till clarity emerges on where the economy is headed.

Nifty is likely to remain in the range 17,800- 182,00. As of now, there are no triggers to break this range in both directions. The only sensible strategy in this volatility is to buy high quality names across sectors during declines.

Views by: V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services

Nifty is likely to remain in the range 17,800- 182,00. As of now, there are no triggers to break this range in both directions. The only sensible strategy in this volatility is to buy high quality names across sectors during declines.

Views by: V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services

9:40 AM

Angel One slips over 1.5% as CEO tenders resignation

Chief Executive Officer Narayan Gangadhar tendered his resignation with effect from May 16, 2023. The day-to-day affairs of the company will be under Dinesh Thakkar as Chairman and Managing Director (CMD).

9:38 AM

RPP Infra bags order worth Rs 60 crore

The company secured a new order worth Rs 59.92 crore for construction of integrated storm drain works in M1 and M2 in Kovalam Basin in expanded areas of Greater Chennai Package 8, which covers various streets of zone 14. The project is expected to be complete within 24 months from the appointed date.

9:37 AM

Railtel Corp advances 2% on order win from Bangalore Metro

The company bagged an order from Bangalore Metro Rail Corporation to supply, install, test, and commission the IT network infrastructure amounting to Rs 27.07 crore and comprehensive annual maintenance contract worth Rs 6.22 crore per year for 5 years extendable to 10 years.

9:36 AM

Greaves Cotton rises 2% as arm forays into high-speed electric two-wheeler segment

The firm's e-mobility business, Greaves Electric Mobility, forayed into high-speed electric two-wheeler segment with the launch of Ampere Primus at Rs 1.09 lakh. The management said that company continues to embody 'Make-in-India' thrust, with high degree of localisation, domestically sourced components.

Topics : Sensex MARKET WRAP MARKET LIVE Nifty Markets Sensex Nifty Indian markets Buzzing stocks stocks to watch FII flows DIIs Rupee vs dollar Adani Group BSE NSE Global Markets

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Feb 17 2023 | 8:07 AM IST