Shankar Sharma at BFSI Summit: Budget 2023 shouldn't tinker with LTCG tax

Market closing: The S&P BSE Sensex dropped 241 points to end at 60,826 levels in a broad-based sell-off. The Nifty50 gave up the 18,150-mark to close at 18,127, down 72 points

)

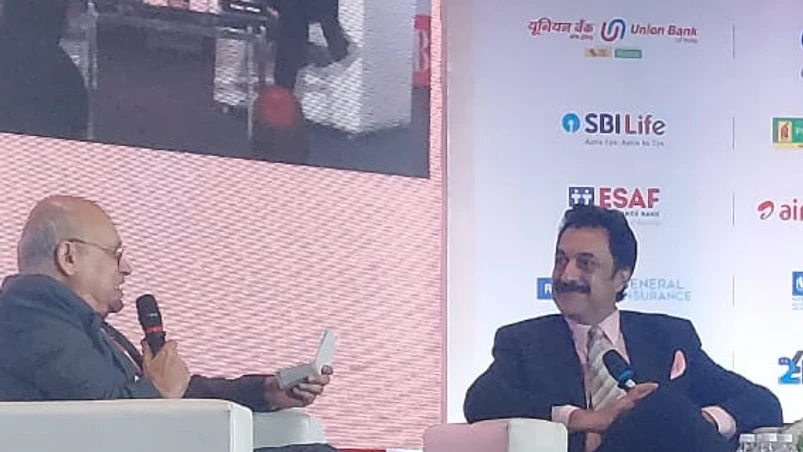

BS BFSI Summit LIVE: The fireside chat with market maven Shankar Sharma is underway on the second day of the Business Standard BFSI Insight Summit. Shankar, in conversation with BS' editorial director, AK Bhattacharya, is sharing his views on the road ahead for the markets amid global volatility. WATCH LIVE

CLOSING BELL

Stock market highlights: Equities languished in red on Thursday as fears of a global slowdown amid Covid-19 fears in China and likely recession in the US and Europe weighed. The S&P BSE Sensex dropped 241 points, or 0.4 per cent, to end at 60,826 levels in a broad-based sell-off. The Nifty50 gave up the 18,150-mark to close at 18,127, down 72 points or 0.4 per cent.

The indices hit their respective lows of 60,637.24 and 18,068.60 during the day.

The Nifty PSU Bank and Realty indices fell over 1 per cent, while the Nifty Auto, Private Bank, and Media indices declined 0.8 per cent each. Individually, UPL, Bajaj Finserv, IndusInd Bank, L&T, Tata Steel, BPCL, M&M, Tata Motors, Dr Reddy's Labs, and Axis Bank slumped up to 2.45 per cent.

Meanwhile, in the broader market, the BSE MidCap index dipped 0.77 per cent, and the SmallCap counterpart slipped 1.8 per cent.

4:04 PM

BFSI Summit LIVE: Politics serves a central role to the equity markets, says Shankar Sharma

4:02 PM

![]()

BFSI Summit LIVE: Budget 2023 should not increase LTCG for the time, says Shankar Sharma

4:00 PM![]()

BFSI Summit LIVE: If real estate is hurt by raising rates, it will hurt overall growth, says Shankar Sharma

3:56 PM

BFSI Summit LIVE: Don't think RBI should have raised interest rates, says Shankar Sharma

3:54 PM![]()

BFSI Summit LIVE: Internal debt to GDP & external debt to GDP conservative indicators of economy, says Sharma

3:47 PM![]()

BFSI Summit LIVE: India will feature in the top two performing markets going ahead, says Shankar Sharma

3:46 PM![]()

BFSI Summit LIVE: China uses huge accumulation of debt to fund growth, says Shankar Sharma

>> The real estate bubble busted in Chinese economy due to huge debt accumulated to fund business growth

3:43 PM![]()

BFSI Summit LIVE: Investors prefer India over China post pandemic, says Shankar Sharma

3:41 PM![]()

BFSI Summit LIVE: India stands 2nd after US in terms of investment returns, says Shankar Sharma

>> Building blocks of Indian markets were laid in 1991

>> Taiwan's market cyclical in nature due to semi-conductors

>> Equity market returns over 30 years has been the US

>> India is the second in the world, in terms of returns after US

>> Taiwan's market cyclical in nature due to semi-conductors

>> Equity market returns over 30 years has been the US

>> India is the second in the world, in terms of returns after US

3:38 PM

![]()

Sectoral Movers: Nifty Auto, PSU Bank, Realty worst hit

3:35 PM

![]()

Sensex 30 Heatmap:: 24 Losers v/s 6 Gainers

3:35 PM

![]()

BFSI Summit LIVE: Indian markets playing catch up with global peers, says Shankar Sharma

3:34 PM

![]()

CLOSING BELL:: Nifty 50 ends at 18,127, down 72 points

3:32 PM

![]()

CLOSING BELL:: S&P BSE Sensex ends 241 points lower at 60,826

3:25 PM![]()

Trillions wiped off, here's how 2022 shocked, rocked global markets

Trillions of dollars wiped off world stocks, bond market tantrums, whip-sawing currency and commodities and the collapse of a few crypto empires - 2022 has been perhaps the most turbulent year investors have ever seen, and for good reason. READ MORE

Topics : Sensex MARKET LIVE Nifty BSE NSE Market trends Indian markets FII flows DIIs Crude Oil Price Rupee vs dollar Global Markets stocks to watch Buzzing stocks Reliance Industries Glenmark Pharmaceuticals GR Infraprojects Kalpataru Power Transmission

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 22 2022 | 8:05 AM IST