Traders rolled over fewer bets in the July series, owing to less favourable risk-reward ratios, with benchmark indices surging to new 52-week highs.

Rollover is a process in which investors carry forward their positions in a derivatives contract from one expiry date to another. Traders can either let a position expire or carry forward their bets — that is, enter into a similar contract, expiring at a future date.

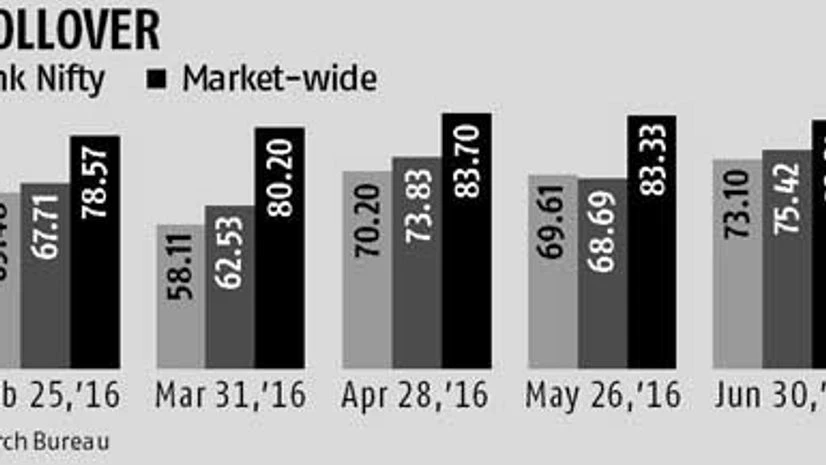

In India, equity derivatives expire on the last Thursday of each month. Usually, contracts are rolled over to the next month. Rollover numbers don’t have a definite benchmark but are expressed as a percentage of rolled positions to total positions. The Nifty rollovers for July were 59 per cent, lower than the six-month average in percentage terms but in line with the number of contracts. Healthy rollovers were witnessed in the media, metals, fast moving consumer goods, pharmaceutical and finance sectors.

The cost to roll over contracts, or roll cost, hovered at 0.5 per cent on Tuesday and Wednesday but fell to 0.38 per cent on expiry day, said experts. The cost is the price traders paid to replace current month futures with August securities. The decline in rollover cost indicates the overall trend remains positive but traders have not carried forward positions aggressively and are looking for meaningful declines to add positions.

“We have seen a long build-up by foreign institutional investors (FIIs) in index futures and the overall trend remains positive. Any correction in the indices will be seen as a buying opportunity,” said S Hariharan, head of sales trading at Emkay Global Financial Services.

FIIs purchased shares worth Rs 9,120 crore in July, taking the year till date purchases to Rs 28,369 crore.

The Nifty closed the July series with gains of 4.6 per cent and settled 125 points higher than its monthly volume weighted average price, indicating longs still had an upper hand. “The index has formed a bullish candle and has been making a higher top-higher bottom formation, giving a hope for the next leg of rally. The index has to continue to hold above 8,550 to witness a fresh up-move towards 8,750-8,777. On the downside, it has multiple supports at 8,510, then 8,475,” said Chandan Taparia, derivatives analyst, Anand Rathi Financial Services.

On Monday, the BSE Sensex closed 0.7 per cent higher at 28,208; the NSE Nifty ended 0.6 per cent higher at 8,666.

The India VIX Index, which measures investors’ perception about the risk of sharp swings in the market, fell for a third day to close at 15.14. The stock volatility gauge has remained steady after seeing a rise in the aftermath of Britain’s vote to exit the European Union.

The highest put open interest (number of unsettled contracts held by market participants at the end of the day) is at 8,500 strike in the August series, while the highest call OI is at 9,000 strike, said experts. “OI concentration is scattered at different strikes but the put OI at 8,500 will shift the support base on the higher side and take the index on higher zones,” said Taparia.

)