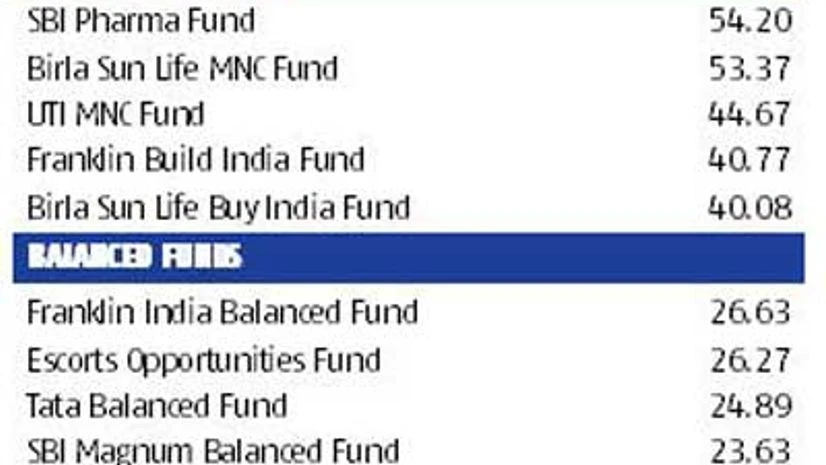

The listing in the preceding pages gives information on the performance of mutual fund growth schemes based on investment category they belong to and with a corpus of over Rs 2,000 crore. For the full list schemes, visit business-standard.com/mf/2015.htm. Returns (adjusted for pay-outs where applicable) and NAV are for 12 months ended June 30, 2015. Data has been sourced from ICRAOnline.

Equity fund returns for periods up to one year have been calculated in absolute terms, while for periods above one year they have been computed on a compounded annualised basis. The same applies to balanced funds. For all long term debt and gilt schemes, returns for periods below one year have been calculated on a simple and on a compounded annualised basis for periods of more than one year. (FUND DIRECTORY)

All short-term fund returns are computed on a simple annualised basis.

The fund ranking is done separately for the various categories and not across categories. Expense ratios and latest corpus figures are based on the latest published figures by AMCs. Risk-free returns for computing the Sharpe ratio have been assumed at 8.27 per cent. Category averages are the simple mean.

The Fund Managers of the year have been selected based on risk-adjusted returns. This is arrived at by estimating the return per unit of risk for the schemes for the last one year. For the purpose of rankings, the bottom 10 percentile of the funds was excluded.

For equity funds, only open-ended diversified funds, whether large-cap or mid-cap were considered. Sector or theme funds were not eligible. The daily returns on the NAV (net asset value) and a risk-free return of 8.27 per cent were used for the purpose of calculation of the Sharpe ratio.

In both categories, namely, equity and debt, the performance of all schemes managed by a fund manager was considered. Besides, weight was also assigned to the total funds managed by a fund manager to arrive at the Adjusted Sharpe Ratio.

Moreover, the fund manager should have managed the scheme for at least the one year to be eligible for the award.

R Janakiraman and Roshi Jain of Franklin Templeton India AMC were the winners in the equity category. Santosh Kamath and Kunal Agrawal of Franklin Templeton India AMC were the winners in the debt category.

)