The uptrend continues with stronger global sentiment as well as some pickup in domestic outlook. The Nifty has moved above 7,700 and the uptrend looks likely to last till the Reserve Bank of India (RBI) policy meet (April 5) at least, in terms of time. A test of resistance between 7,850 and 7,950 could be on the cards and that is crucial. Breadth has been good and there's been high volumes. Domestic institutions (DI) have sold into the rally but foreign institutional investors (FIIs) have been big buyers. The rupee has gained substantially.

The US Federal Open Markets Committee left rates unchanged but it produced an advisory, which is being interpreted as positive. Consensus suggests that the Fed is not likely to hike rates more than twice in 2016. The Bank of Japan (BoJ) also chose to leave rates unchanged. So, did the Bank of England (BoE), while remarking on pressure caused by the possibility of Brexit. The BoJ and the BoE will continue with their respective Quantitative Expansions.

Read more from our special coverage on "DERIVATIVES STRATEGIES"

The dollar has crashed and so has the pound. The rupee has gained considerably due to the FII inflows as well. If the RBI does cut rates in April as looks likely, there will be rupee volatility. In theory, the rupee should ease down as its interest rate differential versus dollar (and other currencies) narrows. But in practice, a rate cut may spark off even stronger inflows and that would tend to push the rupee up.

We can't yet confirm that the major trend has turned around, although the intermediate trend is obviously up. The market slid 2,300 points or roughly 25 per cent in the 11-month bear market between its all-time high of 9,120 in March 2015 and its low of 6,825 on Budget Day. The 200 Day Moving Average (200-DMA) is trending at around 7,900. There is big resistance above the current zone of 7,700-7,750 and resistance all the way till the 200-DMA and beyond. A move beyond 7,900, ideally closing values above 7,900 would be very encouraging. As such, targets in the 7,850 look very possible and 7,900 is quite likely to be tested. Above 7,900, the trend challenges the 200-DMA and a move above the 200-DMA would suggest that the major trend has gone bullish again.

Expiry effects are visible in the Nifty options series. Open interest (OI) in the Nifty call option chain for March tapers above 8,100c. The March put option chain still has a lot of OI all the way down to 7,000p. The Nifty's put-call ratios are still looking healthy at above 1.2.

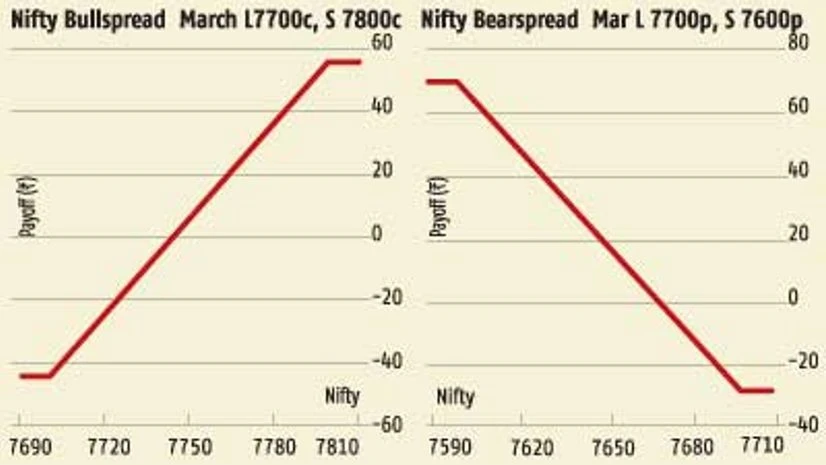

The Nifty closed at 7,705 on Monday. The bullspread of long March 7,700c (69) short 7,800c (26) costs 43 and pays a maximum 57 and this is on the money. The bearspread of long 7,700p (58), short 7,600p (28) is also on the money with a cost of 30 and maximum return of 70. Obviously the consensus favours a continued rally. A long- straddle - short strangle set combining these options, (long 7,700p, long 7,700c, short 7,600p, short 7,800c) costs 73 however, and pays only 27. Of course, any sharp move would put this in the black. But, it is probably better to take a view on either trend than to try and cover both possibilities at this stage of settlement.

)