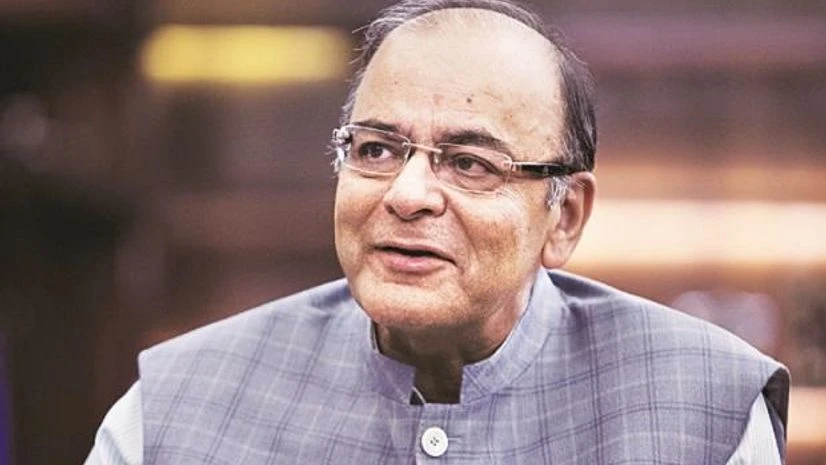

Encouraging the notion of a cashless economy, Union Finance Minister Arun Jaitley on Saturday said that large amounts of cash flowing in the economy have their own curses, most importantly being the factor that crime, corruption and terrorism thrive on.

"India is a cash user society. There are both economic and social costs involved in excessive use of cash. Cash has anonymity; ownership is not identified easily. While users are under risk, [the] state suffers in terms of tax non-compliance. Crime, corruption and terrorism flourish on cash," said Jaitley, while speaking at the inauguration of Vijaya Bank's '100 digital villages, 100 branches, 100ATMs' initiative.

"The banking sector is undergoing a major change, with the advent of technology. There will soon be a time when banking will be a part of smartphones. However, transforming into a developed economy from a developing one would mean taking up the path of a cashless economy," he added.

Citing the impacts of the November 8 demonetisation drive, Jaitley noted that the move has led to the eradication of anonymity of ownership of cash, adding that it is bringing the economy more towards digitization. Further, he stated that with this move in place, there has been an expansion of the tax base.

Backing the introduction of goods and services tax (GST), Jaitley said that the new tax regime will expand the base of indirect tax, as the temptation and possibility of cash dealings gets eliminated due to lack of benefit from input credit. This, Jaitley opined, is a self-correcting mechanism.

With the completion of three years of the Pradhan Mantri Jan Dhan Yojana (PMJDY), Jaitley said 300 million more people were included in the financial sector.

More From This Section

"When the PMJDY was flagged off, 42 per cent of Indians did not have a bank account. Three years after this, 300 million more people have been added to the financial sector. The next step is to identify the beneficiaries of such welfare schemes. The spread of financial inclusion and digitisation to the rural sector should be natural," he said.

"Incentivisation was necessary to financial inclusion. When bank accounts were opened, RuPay cards were provided to account holders. This will not only empower digitisation, but will also help break the myth that the poor will not be able to tune themselves to technology, as cash is neither beneficial to an individual nor the country, as it is an insecure mode of payment. We must further popularise features similar to the RuPay card," said Jaitley.

)