After subdued demand and realisation in the past few quarters, optimism started setting in after the Budget. The government outlay to the infrastructure sector (40 per cent of cement consumption) and the rural economy bodes well.

Read more from our special coverage on "CEMENT"

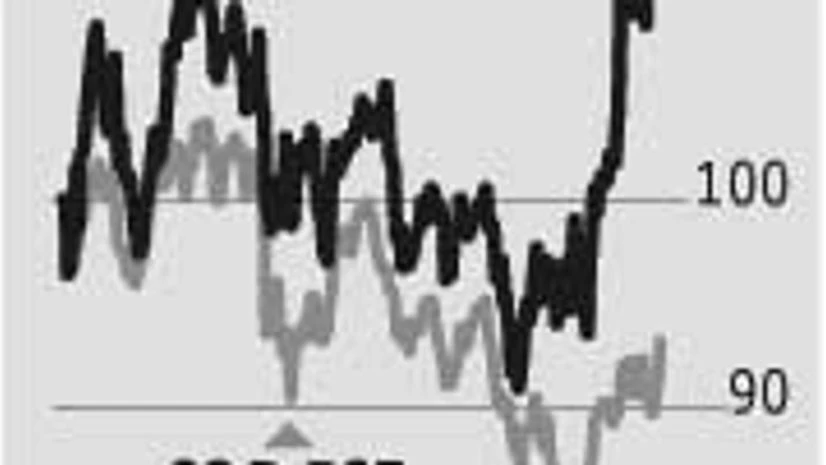

Demand in south should improve given increasing commitments by Andhra Pradesh and Telangana. This bodes well for India Cements, which has surged from Rs 67 in end-February to Rs 93. Orient Cement (produces in Telangana) is also likely to be benefit. Orient has also added capacities in Karnataka. So will Sagar Cements, which may see volume growth of 15 per cent in FY17, say analysts at Motilal Oswal Securities, led by acquisitions of BMM Cements in August 2015. Sagar Cements hit a new high of Rs 610 on Wednesday and trades at Rs 594 now.

Players such as Dalmia Bharat, present in north-east and south, may see larger benefits led by increased road projects in north-east.

March quarter results, while expected to be better than that of the December quarter, may not fully reflect benefits of improved realisations as most price increases have come in March. Average selling prices are seen down six-eight per cent year-on-year. This will be eased by strong volume growth.

Analysts at Emkay Research say among large companies, Shree Cement, Ambuja Cement, ACC, and UltraTech are expected to report volume growth of nine-29 per cent year-on-year. Among mid-caps, they expect Orient, JK Lakshmi, and JK Cement’s volume to grow 13-41 per cent year-on-year.

Lower pet coke and coal prices should boost profits. Analysts at Reliance Securities say the March quarter would be best in terms of lower operating costs per tonne as these would decline three per cent year-on-year.

The ongoing consolidation is a key long-term positive.

)