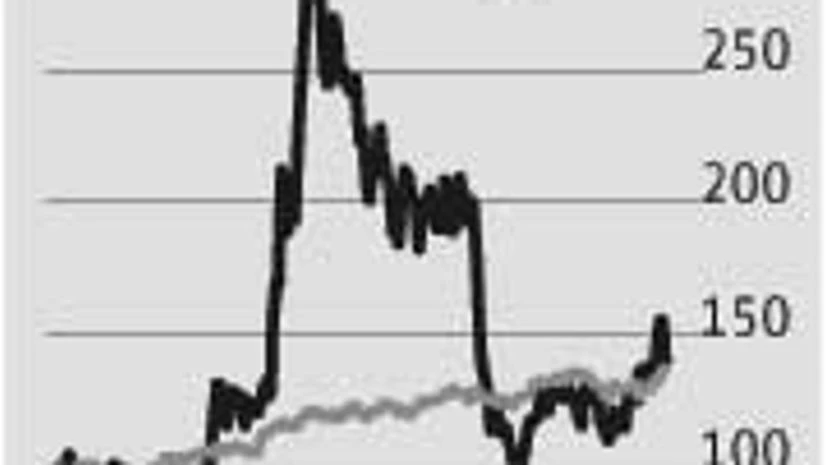

Suzlon Energy’s deal to sell 100 per cent stake in Senvion SE to Centerbridge Partners LP, USA has not gone down well with the Street, as the stock fell 7.5 per cent to Rs 15.91.

While the acquisition was financed through debt, it did not yield desired results due to the global slowdown and withdrawal of incentives by various governments. Suzlon’s debt, thus, soared to Rs 17,091 crore at the end of FY14. While it has recently reduced debt by Rs 450 crore, the pressure remains.

Though the move will cut its debt to Rs 9,400 crore, the key concern is how it will service the rest? In FY14, of its consolidated revenue of Rs 20,212 crore, Senvion contributed euro 1,806 million (Rs 14,448 crore, considering euro to rupee rate of 80). Of the group’s Ebitda (earnings before interest, tax, depreciation and amortisation) of Rs 115 crore before forex losses, it contributed euro 146 million (Rs 1,168 crore). Also, of Suzlon’s order book of $6.3 billion at end-September, Germany contributed 46 per cent (to be serviced through Senvion).

Thus, it’s imperative for Suzlon to turn around its Indian and US operations.

The Indian government has re-introduced policies that allowed wind power projects to benefit from accelerated depreciation (tax incentives), besides raising generation-based incentives. The new Companies Act also allows renewable energy and wind turbine generators to qualify as corporate social responsibility activity.Over the past three years, Suzlon has lowered manpower and fixed expenses (India-based) by a fourth.

Tulsi Tanti, chairman, Suzlon Group, said, “In our business Ebitda and profitability is a function of volume, which were constrained due to high leveraging and liquidity challenges. With this transaction, we are deleveraging, reducing the interest burden and getting more capital to ramp up volumes. We have a large order backlog and strong service revenue earned from our 14,500 Mw installation across the globe.”

)