The global economic engine looks likely to stutter this year. US gross domestic product (GDP) printed at an annualised 0.2 per cent in Q1 (January-March 2015), way below Q4's 2.2 per cent and also well below the 1 per cent consensus for Q1. Markets were braced, given low consumer confidence numbers and sharp decline in trade figures. It was still a shock and it comes on the heels of China revising 2015 GDP projections down.

The Federal Open Market Committee concluded its meeting without raising dollar rates. It is quite likely now that the US Federal Reserve will postpone hikes till September at least, or even till 2016, given US weakness. However, even that reprieve from a hike did not lift spirits. US equity indices, which had hit all-time highs recently, saw pullbacks.

If the two biggest economies, America and China, are both slowing, it is unlikely that the euro zone can provide a counter-balance, even assuming the Greek situation resolves without chaos. As of now, there appears to be some confidence that a deal will be worked out and the Grexit averted. But this is all in the air. Another potentially destabilising event is the UK elections, which could affect the pound. Japan has also released weak industrial output numbers, which further dampened sentiment.

In India, the political logjam around the amendment to the Land Acquisition Act continues. That hasn't helped sentiment, which has also been hit by sub-par Q4 results and shifts in foreign institutional investor (FII) attitude. The FII buy/sell numbers for April are distorted by Daiichi's exit of Sun Pharma, which meant that over Rs 20,000 crore was traded out in a single day.

Adjusted for that, FIIs sold a fair amount of equity and they were also net-sellers in rupee debt. This is the first month since September 2013, when FIIs were net-sellers in both segments. The lack of clarity around MAT (minimum alternate tax) demands could be one reason for bearish FII sentiment.

However, Q4 results have also been nothing to write home about, though it's early days. Of the Nifty 50, 12 companies have reported in and the aggregate net profits of that set has reduced 11 per cent. Several infotech majors have reported in, with below consensus results and projections. Banks have done somewhat better than expected so far, although the public sector undertaking bank majors (which could deliver unpleasant surprises) have not reported in. Maruti Suzuki is up in profitability, due to the strong rupee, which helped with yen-denominated payouts.

Cement majors ACC and Ultratech have taken a hammering. So has Cairn, which also faces a massive tax demand. Cairn's profits were hit by low crude prices. The parent, Vedanta, has taken a record book entry impairment of over Rs 20,000 crore equivalent on account of losses in the value of crude.

But the latest trend in crude is up and gas prices have also risen. Brent (which is usually priced quite close to the Indian crude basket) hit five-month highs last week at $66/barrel. Indian pump prices of petrol and diesel were hiked sharply on the weekend. The rupee is also under some pressure at the moment.

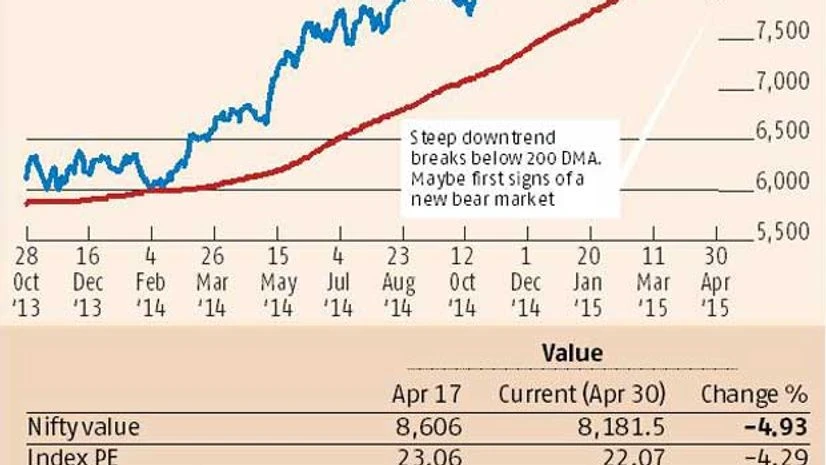

Equity indices fell sharply through the past fortnight with the Nifty dropping almost 5 per cent in the last 10 sessions. The Nifty has now seen a 10 per cent correction from the record high of 9,119 (recorded on March 4).

All the technical signals were negative last week. The Nifty broke below its own 200-day moving average (200 DMA), for the first time since September 2013, which is interpreted as a sign of serious bearishness. Month-on-month, both March (over February 2015) and April (over March 2015) saw declining stocks far outnumbering advances.

One issue with this sort of technical signal is that it can trigger cascaded selling. Trend traders set stop losses below the 200 DMA and exit, or go short, as the stop losses are hit. The long weekend offers some time for traders to catch their breath and presumably FIIs will take stock of the implications of the Fed not raising rates. If the FII attitude does stay negative, we could see more losses.

Disclaimer: These are personal views of the writer. They do not necessarily reflect the opinion of www.business-standard.com or the Business Standard newspaper

)