The broad nature of the bad loans and management commentaries indicate asset quality pressures are likely to continue in 2013-14 as well.

“We believe the March 2013 quarter may see more restructuring by PSBs. While metals and textiles segments are currently under pressure, the infrastructure segment is better placed on the asset quality front, as most of the projects are under implementation. However, three to six months down the line, infrastructure loans could also come under stress. Thus, we prefer banks with lesser exposure to the infrastructure space,” says Vaibhav Agrawal, vice-president, research, banking, Angel Broking.

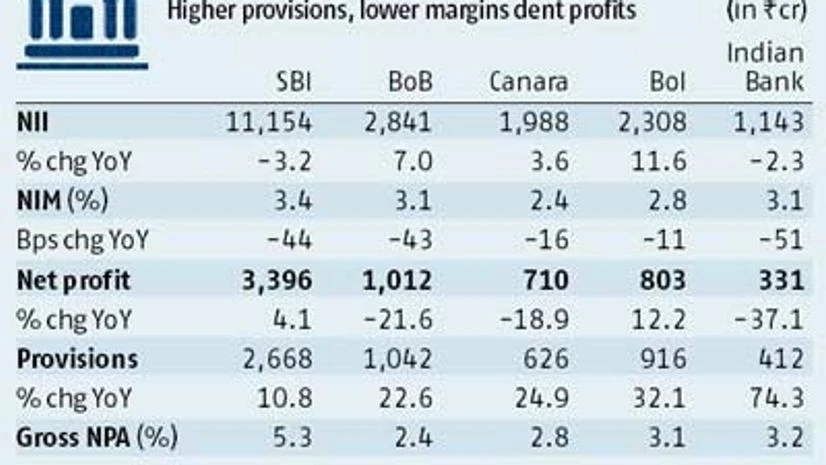

Most of the large PSBs — State Bank of India (SBI) , Bank of Baroda (BoB), Canara Bank, Indian Bank and Bank of India (BoI) — saw a sharp rise in their provisioning for bad loans (up between 10 and 81 per cent).

In fact, the provisions are much more than net profits in a few cases. As a result and with growth in net interest income (NII) subdued, many of these (except BoB) witnessed a fall or only negligible growth in net profit (see table). SBI, the country’s largest bank, is a case in point. Its provisioning rose 11 per cent over the December 2011 quarter and fresh slippages remained high at Rs 8,165 crore. Consequently, its net profit growth was a mere four per cent as against Street estimates of 10 per cent. Vaibhav Agrawal says, “SBI’s asset quality was worse than our expectations. Slippages, non-performing asset ratios and provisioning deteriorated more than expected.”

The trend in recoveries, though, remained mixed for the quarter. While SBI, BoB and Canara Bank saw a 26-67 per cent sequential fall in recoveries, the figure increased by 25 per cent and 11 per cent for BoI and Indian Bank, respectively.

Easing of interest rates, coupled with higher credit offtake, could have a positive impact on these figures. However, as such benefits accrue with a lag, the improvement will be visible only gradually, believe analysts.

)