Jubilant FoodWorks put up a poor show for the March quarter with the lowest ever same -store sales (SSS) growth of 7.7 per cent restricting its top line growth to 29.3 per cent. The sales growth was the lowest since the March 2010 quarter and is a function of slowing discretionary spending by consumers. It registered a first ever sequential fall in revenues of five per cent over the December 2012 quarter. While the management remains optimistic about a pick-up in SSS growth, it estimates some structural slowdown to set in.

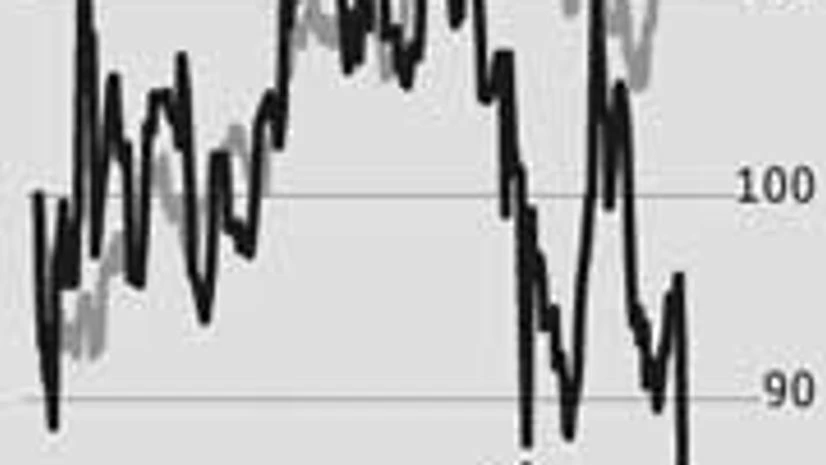

Ajay Kaul, chief executive officer, Jubilant FoodWorks, says, "We expect SSS to climb back in about two-four months by when the economy is also likely to recover. However, the erstwhile SSS growth figures of 25-30 per cent look improbable and we expect this metric to grow by at least 10 per cent in FY14." SSS growth has already moderated from 29.7 per cent in FY12 to 16.2 per cent in FY13. Slowing SSS pulls down Jubilant's revenue growth, which in turn has a bearing on its margins.

Not surprisingly, its earnings before interest, tax, depreciation and amortisation (Ebitda) margins too, contracted by 180 basis points (bps) over the March 2012 quarter to 16.7 per cent. Further, factors such as aggressive store additions, high capex of Rs 250 crore, sustained advertising and marketing spends will keep margins under check. The management expects input cost inflation at between five and seven per cent in FY14 and plans to mitigate it via phased price hikes of 2.5-3 per cent. However, new stores additions (at least 18 in FY14) in the Dunkin' Donuts business are likely to weigh on its Ebitda margins in the next couple of years. The management expects to keep the Ebitda margin at a minimum of 16.5 per cent in FY14, a contraction of 90 bps over FY13 margins. Total expenses surged 33 per cent, resulting in a net profit growth of just 11.5 per cent to Rs 32.7 crore.

While new stores contribute strongly to revenues, they also increase the risk of cannibalisation for existing stores in neighbouring areas, especially in metros, where Jubilant has about 60-90 stores each. However, the company does have the lever of increasing store additions in non-metro cities, though business in these cities is less attractive. The good news is that Jubilant's online delivery model, which would reduce administrative costs, grew strongly and now forms 17 per cent of total sales as against 14.6 per cent in the December 2012 quarter. The management expects to post similar growth in this channel in FY14 as well.

)