A sharp decrease in fuel costs, coupled with strong operational performance, helped SpiceJet return to profitability at the operating level. As against a Rs 7.7 crore loss in the year-ago quarter, earnings before depreciation, interest, amortisation and rentals (Ebitdar) was Rs 172 crore. Including rentals, pertaining to planes taken on lease, operating profit was Rs 2 crore as against a loss of Rs 267 crore in the year-ago period. Strong load factors (at 93 per cent, highest for the sector) and passenger volumes helped post revenue of Rs 1,040 crore. While this was 28 per cent lower than the year-ago quarter, it is mainly due to the company’s capacity being 34 per cent lower, due to fleet reduction. Adjusted for this, revenues were up 14 per cent year-on-year. While higher loads was also a function of aggressive pricing, the company managed to improve the revenue per available seat kilometre (R/ASK) from 3.4 in the September quarter last year to 3.86 a growth of 14 per cent.

Though strictly not comparable given the fact that September quarter is a seasonally weak one as compared to the June quarter, revenues were down about 7 per cent sequentially. However profitability was down sharply given June quarter’s Ebitdar of Rs 267.5 crore, and Ebitda (including rentals) of Rs 107 crore. One reason is the decline in R/ASK from four in the June quarter (thanks to aggressive pricing) to 3.86 in September quarter, while an increase in maintenance and other expenses are also responsible for the dip in profitability.

Despite the huge savings on fuel and strong operational show, SpiceJet was not able to post a significant profit at the operating level. The reported profit of Rs 24 crore was boosted by other income of Rs 73 crore. The results include a restructuring gain of Rs 65 crore and currency revaluation loss of Rs 23 crore.

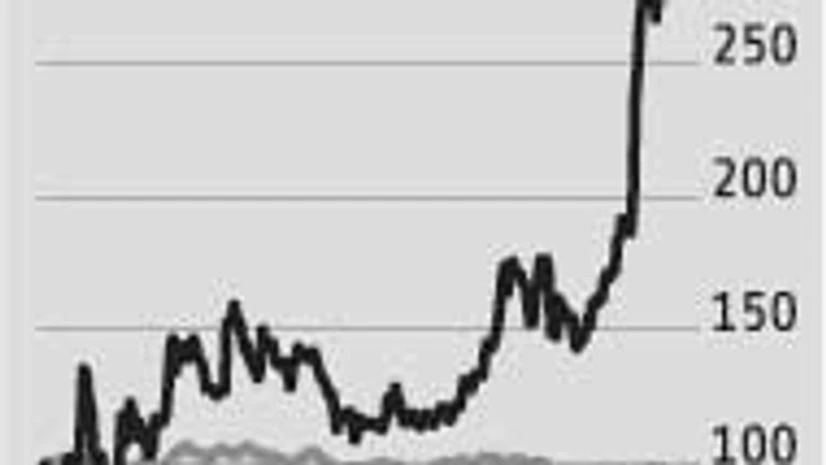

But, things should change for the better. With lower fuel prices and load factors upwards of 90 per cent, SpiceJet’s performance should see improvement in December quarter, which is the strongest in the year. But, to reap the gains from lower fuel costs and higher demand to the fullest extent, it also has to improve its yields further something the Street will closely monitor. For now, the stock, which gained about three per cent on Wednesday, could see some gains on Friday.

)