India’s third-largest pharmaceutical company by revenue is on the ball. Over the past few days, Lupin has received approval from the US FDA to launch the generic versions of three key drugs — Trilipix, anti-HIV drug Trizivir and Cymbalta (delayed-release capsules used to treat depression).

The company announced the launch of Tirzvir the same day the US District Court of Delaware announced Lupin’s abbreviated new drug application (ANDA) did not infringe the existing patent.

The company gets a 180-day period for exclusivity launch and marketing this drug, as it was the first to file in 2011. The drug generates sales of $110 million in the US every year and analysts believe even after the 180-day period, competition would be limited. Nomura expects this drug to generate $30 million in annual revenues in FY15 for Lupin. However, the brokerage notes the launch could be at risk, since there remains a possibility of a reversal of the district court’s decision at the appeals court.

Similarly, Cymbalta which went generic this month, is a $4 billion sales drug, according to estimates. Lupin is among six companies that have got FDA approval to launch a copycat version of this drug. Analysts say they were expecting 10 companies to get approvals to launch the generic version of this drug, but, in effect, only six companies have got approvals.

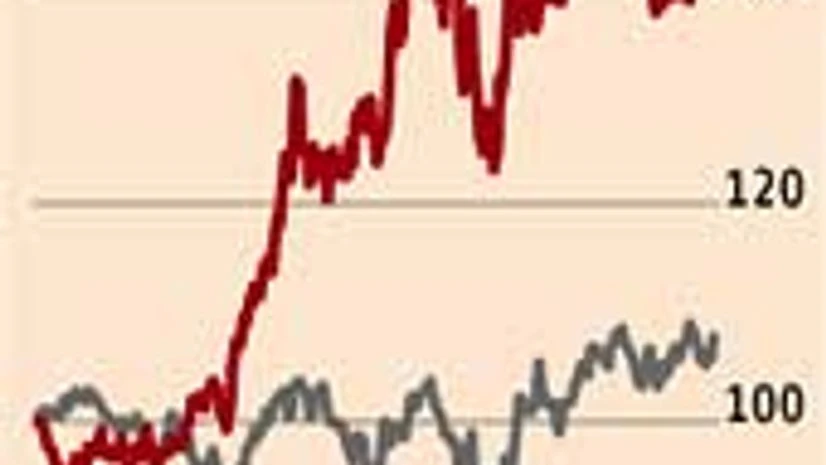

At a broader level, the company has been building capabilities to enter niche segments like opthalmic drugs and oral contraceptives, apart from the first to file opportunities. UBS Securities expects the stock to trade at 25x its FY15 price/earnings ratio, driven by a strong 26 per cent, increase in its earnings per share compounded annual growth rate over FY13-15.

To go ahead with its strategy, the company will need to acquire capabilities, brands and technologies. If it manages to pull off this kind of a growth, it will be well ahead of peers. The company is looking at acquisitions to build this capability.

)