Foreign institutional investors (FIIs) remain bullish on India but are not now rushing to buy stocks. In October, they have turned net sellers of equities. After the pre-election euphoria, both portfolio investments and monthly market returns have cooled. And, the government's reforms process has stalled, thanks to elections in Haryana and Maharashtra, which has also impacted investor sentiment.

Over the past two months, the BSE Sensex has given negative returns (of 0.03 per cent in September and 1.03 per cent in October) and analysts expect markets to remain range-bound in the next couple of months. One may say after rising 26 per cent through the year, the Sensex is taking a breather. Capital flows have also slowed since August. In October, foreign capital flows into equities turned negative, with FIIs selling equities worth $200 million.

Clearly, the government's pace on reforms will determine sustainability of investor interest. In the past four months, Antique Stock Broking says, markets have been in a trading zone, with Sensex returns gradually declining to 4.9 per cent, 1.9 per cent, 2.9 per cent and a negative 0.2 per cent in June, July, August, and September, respectively. There is a shift in terms of sectoral preferences, too, with defensives outperforming for the past few months, as investors await the new government's response to policy making, the brokerage adds.

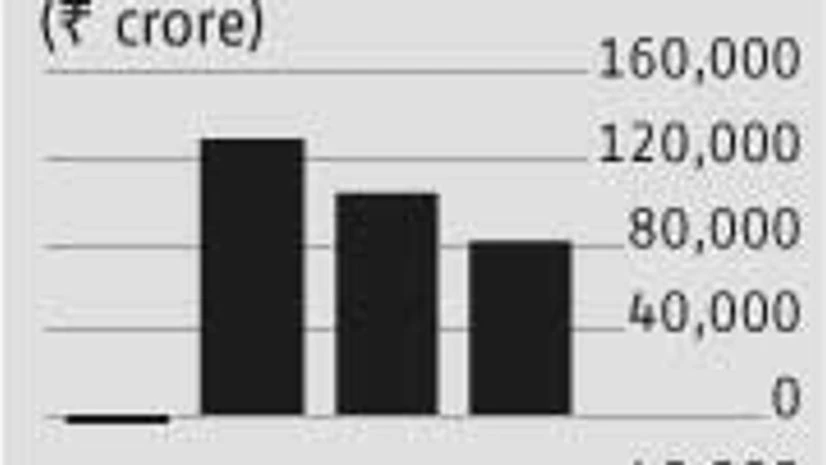

Interestingly, the foreign capital flows into equities have remained lower than in the previous two years. FIIs invested $24.5 billion in Indian equities in 2012, $18.6 billion in 2013 and $13.6 billion in 2014 so far. It's apparent investors are looking for further action on reforms from the Narendra Modi-led government.

)