Maruti’s operational performance, both on volumes and realisations, was robust and boosted its top line performance with core revenues growing 18 per cent over a year to Rs 13,078 crore. While volumes grew 14 per cent, realisations rose four per cent. Realisations were up sequentially, as well as year-on-year (y-o-y). Including other operating income, sales were up 17.5 per cent to Rs 13,424 crore, largely in line with estimates of Rs 13,455 crore.

The bottom line, which grew a strong 57 per cent y-o-y to Rs 1,193 crore, was lower than consensus expectations of Rs 1,270 crore owing to doubling of taxes to Rs 477 crore and a 28 per cent fall in other income to Rs 172 crore.Higher operating leverage and muted raw material costs boosted Maruti’s operating profit to Rs 2,188, up 58 per cent year-on-year. Input costs as a percentage of core sales came down by 479 basis points to 69 per cent. The March quarter had also seen a 560 basis points y-o-y fall in this ratio. A weaker yen helped in the June quarter as the company imports 15 per cent of its raw materials. Maruti indicated its sales promotion costs for the June quarter have been lower.

Given lower input costs and better product mix, margins might stay elevated. Maruti’s efforts to move up the ladder in the premium segment should further boost margins. Recently, it unveiled its branded showrooms called Nexa, which will sell premium products such as the S-cross, expected to be launched this week. Given the portfolio of products and new launches planned, Maruti should reach its medium-term target of two million domestic vehicle sales by 2020.

ALSO READ: Emergency and Sanjay Gandhi: How Maruti's origin lies in cronyism, corruption and blackmail

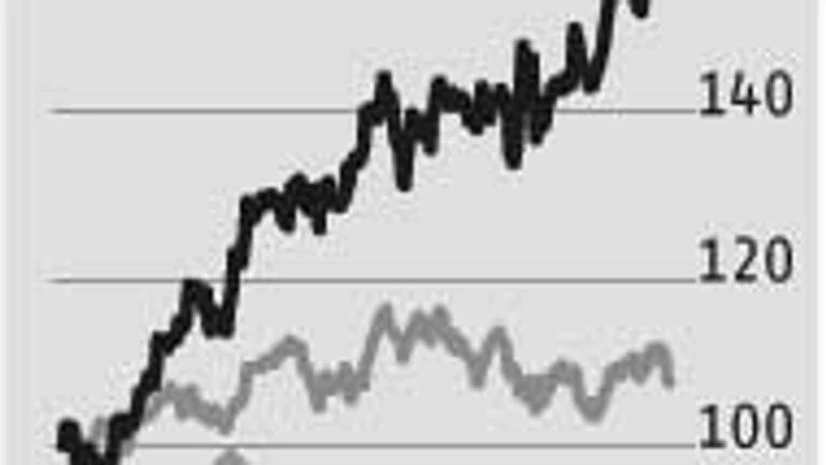

In the near-term, while the return of first-time buyers should help boost sales of entry level vehicles, how sales in the rural markets progress will have a bearing on Maruti’s overall volumes as this segment accounts for a third of its volumes. Higher sales across segments and markets coupled with the success of new launches had helped Maruti gain 300 basis points in market share to 45 per cent in FY15.The stock is trading at 18 times its FY17 earnings. Long-term investors should consider corrections as an entry point, given the belief that India’s auto industry is at the start of an upcycle.

)