Novelis, the American subsidiary of Hindalco Industries, which is a producer of value-added aluminium products, reported a weak performance for the quarter ending March. Operating earnings (before interest, taxes, depreciation and amortisation, or Ebitda) per tonne was around $265, about a fifth lower than in the March 2014 quarter and 15 per cent lower sequentially.

The inability to pass on costs of earlier metal purchases, that Novelis bought at higher regional premiums, impacted the performance and is likely to cause stress in the coming quarters as well, believe analysts. The decline in aluminium premiums (additional price over and above the benchmark rate), especially in Asia, can benefit in the longer run, enabling Novelis to produce at competitive prices compared to Chinese entities. In the near term, however, it will remain a drag on profitability.

The macro headwinds in terms of demand and adverse currency movement have also hurt profitability of the US business. Though weak demand in the cans business could have been offset to an extent by a high and rising margin portfolio for automotive sales, these were offset by a depreciating euro, declining regional premiums and hot mill outage in North America (a one-off) in the quarter, say analysts at Elara Capital.

The volatility in aluminium prices and realisations due to weak demand across regions, especially from China, has been a concern for aluminium producers. While Novelis has been working on capacities, now 3.6 million tonnes a year, it has also worked on automotive sales, up from five per cent to 11 per cent of revenue in FY15. Besides, re-cycled material (helps lower costs) rose to 49 per cent in FY15 from 33 per cent in FY10.

Yet, profitability remains lumpy. Some quarters earlier, the company was seeing a profitability increase due to rising aluminium premiums but these have sine been falling. Analysts at Elara Capital say Ebitda has actually contracted at a compound annual rate of four per cent (over a five-year period) to $902 million in FY15.

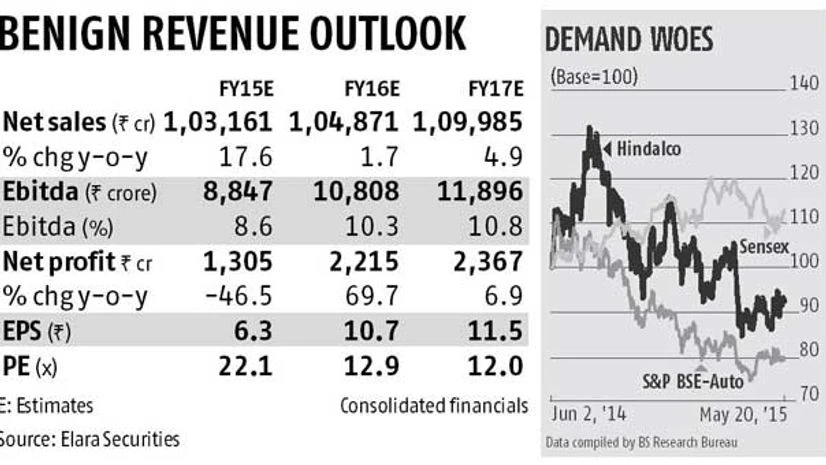

For the quarter ending March, average aluminium prices on the LME at $2,124 a tonne are down seven per cent sequentially and 10 per cent over a year. The outlook for FY16 and FY17 also remains benign, with analysts at Motilal Oswal Securities cutting their average estimates by $50 a tonne each to $1,900 for FY16 and $1,950 for FY17. Hindalco, being a primary producer of aluminium, benefits from higher prices and premiums.

Thus, with challenges in prices and premiums, the Hindalco stock has fallen from Rs 198.70 in July 2014 to Rs 139—it was Rs 158 in early March.

There are some positives, though. The company is raising production in India and will benefit from increasing volumes. Second, it has also been able to get coal blocks to meet 65 per cent of the requirement for its Mahan and Aditya smelters. However, the benefits might take some time to accrue.

The consensus target price for the stock is Rs 168 from analysts polled on Bloomberg this month. These will be reviewed once the results for the quarter and year ending March are out, as is the company’s forecast for FY16.

)