Greece's experience tells us that cash flows are crucial to economic outcomes. No matter how far-reaching the vision, ambition, and slogans, the effects of cash flows are profound and inevitable. Many of our politicians and bureaucrats and a large proportion of the public seem oblivious to how cash flows affect our political economy. This apparent absence of understanding (or flouting of fundamentals by opportunists who understand them but act in their own interests) shows up in many ways among all political parties in their approach to the basics: the provision and pricing of essential services such as security and law-and-order, electricity, broadband communications, transport, water, sanitation, and waste disposal. Without an understanding and acceptance of how essential cash flows are for providing these services, we can't realistically aspire to better living conditions. No matter how well or wealthy you may be, you still have to pick your way gingerly through the mess and the stench of your environs when you step out.

Cash flows are at the crux of the problems our governments face at the Centre and states, and that society is up against. They include all the legacy issues mentioned above of the inadequate infrastructure services that we endure, and extend even to problems such as the defence services pensions. While the National Democratic Alliance is not blameless, there are egregious instances among other political parties, such as the Aam Aadmi Party's (AAP's) actions on waste management and electricity supply in Delhi. The essential sticking points have been delayed (obstructed) cash flows, whether in paying sanitation workers or electricity distributors. These instances are mentioned only as indicative examples, as their processes hark back to the habitual practice of governments at the Centre and the states of delaying payments, whether it is fertiliser subsidies to manufacturers (a central government "habit" for decades), or setting realistic tariffs and making prompt payments to electricity distribution companies, as in the case of state governments running Delhi. Various parties - the Congress until 2014 and the AAP thereafter - have themselves been victims of the structural constraints of electricity generation plants with antiquated, inefficient equipment, as in the old coal-based plant at Badarpur, or efficient, modern plants using gas caught in an upward price spiral with domestic gas not being available, such as at Bawana.

In the communications sector,constrained cash flows limit services. One rough estimate is that cumulative charges for spectrum amount to about Rs 1.8 lakh-crore ($30 billion), roughly equal to the total amount invested in networks and equipment. In other words, operators could have invested double the amount in networks and equipment if it had not been paid in government charges. Operators had to take on significant debt for prior payments, thereby hampering their ability to invest in extending and upgrading their networks.The operators' financial constraints constitute one major reason that a market hungry for data services is starved. (Another major reason is the technology constraint of narrow, noncontiguous bands of spectrum, but that is another tale.)

The situation in electricity supply is much worse, because of the high and still growing level of stressed assets of the state electricity boards. Press reports estimate that as much as Rs 53,000 crore may possibly become non-performing assets (NPAs) by the end of September.

There is a view that stressed assets and NPAs need not be a problem, because they can be readily sold to new owners who could reorganise the undertakings, which could succeed or go out of business if they fail. While this is theoretically possible, in practice, this is quite difficult and impractical to carry out, especially in hard times. Banks typically are not equipped to take over a number of non-performing businesses and run them until they can dispose of them. Secondly, considering the problems of being profitable in bad times combined with generating cash for operations in downbeat markets, it is unlikely that there will be acceptable buyers willing to pay reasonable prices for loss-making assets.

One difficulty in addressing such issues is that the basic concepts - of cash flows, of numbers from operations in the profit-and-loss statement in tightly coupled lockstep with the balance sheet, which leads to the cash flow statement, require a level of effort to understand that many are unwilling to put in. Cash flows are measurements of flow, whereas profit-and-loss and balance-sheet items are accumulated over specified periods, such as a month or quarter, with no relationship to actual cash movements in those periods. There are additional complexities in delving deeper, e.g., in considering the similarities with the flow of liquids. As cash flows are in some ways comparable to liquid flows, there is research from the perspectives of fluid dynamics that requires an understanding of more complex mathematics, physics, or engineering.For those interested in exploring these aspects, further readings are suggested below.1

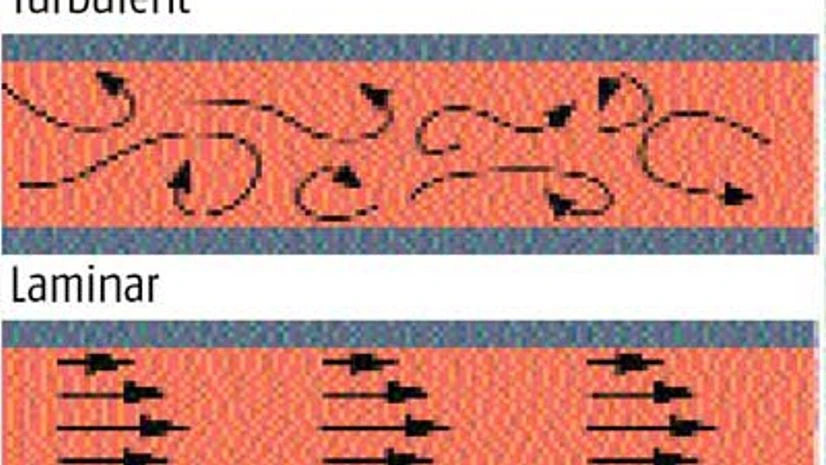

Put intuitively, the key is in setting up and/or taking corrective action to facilitate smooth flows, with the recognition that disruptions create turbulence. Smooth flows are laminar, as the layers or lamina of fluid move easily without mixing (see diagram). Once turbulence sets in, it takes time and often additional effort (resources) to revert to smooth flows, because the obstacles have to be removed or worked around, and the vortices and eddies created by disruptions have to be stabilised and smoothed out.

The point is that if key decision makers have an appreciation of cash flows and simulation techniques, they can be better informed in making decisions to improve flows. This understanding needs to be visceral and at the top levels, and not just among financial and engineering experts. This is why it would be useful for the PM and his team to seek financial, organisational, management and technical inputs.

1. Measuring Financial Cash Flow and Term Structure Dynamics, Cornelis A Los, 30 November, 2001 http://econwpa.repec.org/eps/fin/papers/0409/0409046.pdf, Financial Market Risk: Measurement and Analysis, Cornelis A Los, Routledge, 2003; 2006.

shyamponappa@gmail.com

Disclaimer: These are personal views of the writer. They do not necessarily reflect the opinion of www.business-standard.com or the Business Standard newspaper

)