Despite the accumulation of stressed assets by banks over the past few years, rating agencies still maintain a 'stable' rating on these. Bankers, however, believe if gross domestic product (GDP) growth does not pick up and interest rates don't start coming down, banks could very well become the cause of stress in the financial system.

The primary reason behind this is the rather grim prognosis for the sector in FY15. India Ratings has conveyed to Citi analysts it expects gross stressed assets to rise to 14 per cent by 2015 from 10 per cent currently, possibly the worst-case scenario. Although the stress so far has been in the mid-corporate level, larger accounts are now coming under pressure. The problem in the mid-market segment is higher, due to weak collaterals and economics.

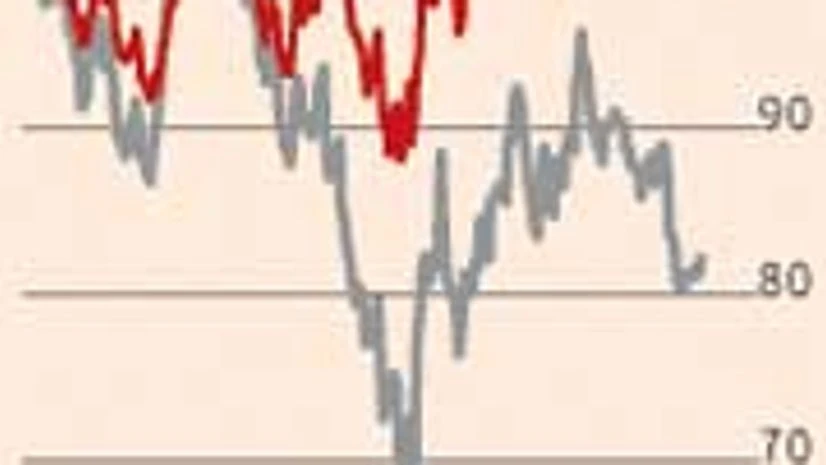

Morgan Stanley analysts believe delinquencies in this segment will be volatile on a quarterly basis, but will remain high. The rise in impaired loan formation will remain elevated in FY15, unless GDP growth picks up.

More From This Section

The average size has nearly doubled to Rs 1,500 crore in the current financial year compared to FY13, which implies larger accounts are now coming under stress. That stress is not expected to abate is apparent from two other pieces of data.

First, of the total CDR cases, 70 per cent was recast in the past two years. Second, the total number of CDR cases being downgraded to non-performing loans is higher than successful exits. In December 2013, merely two cases worth Rs 1,500 crore exited, while 12 cases worth Rs 4,100 crore failed and were downgraded to non-performing loans. Most brokerages are staying away from financials, especially state-owned banks, as the cost of credit will remain high and provisioning will also accelerate in FY14 and FY15.

)