Next time you step into a bank branch and are pitched an insurance policy which does not suit you, your bank will be at fault. Of course, the bank will need to have an insurance broker's license for this.

Recently, the insurance regulator changed the architecture of the bancassurance (distribution of insurance products through banks) channel. Through these regulations, the Insurance Regulatory and Development Authority (Irda) has allowed banks to become brokers, as opposed to corporate agents, for insurance companies. The regulations have come into effect, provided the Reserve Bank of India (RBI) has no objections.

RBI in its Financial Stability Report (FSR) had said banks assuming the role of brokers might lead to conflict of interest. RBI said in some cases, it was observed banks did not have a clear segregation of duties of marketing personnel from other branch functions. Bank employees were directly receiving incentives from third parties such as insurance companies, mutual funds and other entities for selling their products. Experts feel the new regulations are advantageous for potential policyholders.

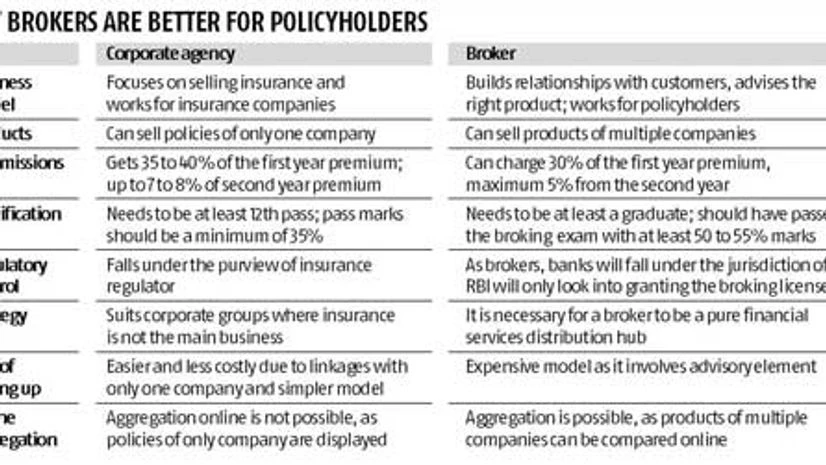

"The business of broking is more customer-centric and that of an agent is manufacturer-centric," explains Monish Shah, senior director at Deloitte India.

This means, as brokers, banks will be responsible for the policyholders (say, mis-selling), which is not the case for corporate agents. In the case of corporate agents, the insurance company is responsible to policyholders. This also means banks will need to be on top of the varied policies they sell, as brokers also need to offer advisory business.

"Once a bank becomes a broker, it can offer products of multiple insurance companies. This will mean more products to choose from for customers," says Deepak Mittal, managing director and chief executive officer of Edelweiss Tokio Life Insurance. Under the current norms, a bank is allowed to become the corporate agent of only one life, one general insurer and a stand-alone health insurer.

The main challenge will be training the staff to have knowledge about all insurance products across insurers. However, there isn't surety that appointing banks as brokers will reduce mis-selling. Says a senior executive of YES Bank: "Because we don't have an insurance firm, we might be impartial to products from all insurers. However, the same might not be true for banks which have insurance firms as subsidiaries." A lot of mis-selling is known to happen through bank branches where bank customers are coerced into buying policies.

These regulations will be beneficial for insurers which do not have banks as promoters. Such firms have long been asking for an open architecture for bancassurance, like these norms. Even the finance minister had asked for banks to be permitted to act as insurance brokers in the Union Budget 2013.

However, despite being brokers, there are chances that banks with insurance arms will push their products to customers, says Sanjeev Pujari, appointed actuary of SBI Life Insurance. Bankers question why they shouldn't do so. "These norms will increase competition and, hence, pushing our own products will be more important," says a private sector banker.

"Conceptually, these regulations should help stem mis-selling, as only the best product possible should be sold as per the client's needs. But whether it happens or not will need to be seen," adds Pujari.

Most bankers and insurers aren't confident of stemming mis-selling with these norms. While insurers feel banks don't equip their staff to be able to strike a good deal with customers in terms of selling the right policy to the right customer, banks lament mis-selling also happens at the insurers' ends.

No bank has yet applied for a broker's license. And, banks are not very enthused about being insurance brokers as well. Banks still have the flexibility to choose between being an insurance agent or a broker. Also, they can't do more than 25 per cent of the business from the insurance company within the promoter group. Technically, an agency model is more profitable than the broking one. "An insurer invests in an agency by training the agency staff and so on, which brokers need to do themselves. Broking is a complex business, which banks might not be comfortable with. Especially from a stakeholders perspective, it's not very attractive," explains Shah.

So, experts feel many banks might not apply for a broking license. Shah believes foreign banks are likely to make the first move relatively over Indian private banks, as foreign banks are used to advisory businesses that are profit centres.

Remuneration is the other issue. Agencies and brokers get for policy sales a fixed percentage of the annual premium every year. The commission is the highest in the first year and lowers as the policy continues. But a broking firm is paid less than agents. "Brokers can earn 30 per cent of the first year premium and up to five per cent of the second year premium. Agents get paid eight to 10 per cent more than brokers," says an executive from State Bank of India.

In its regulations on licensing banks as insurance brokers, Irda said each applicant (scheduled bank) should have obtained prior approval of RBI before applying for a license to act as an insurance broker. The license, once granted, will be valid for three years, after which it can be renewed.

)