Equity fund inflows are showing signs of a turnaround. A number of closed-end funds received healthy inflows at a time when investors have largely been closing equity fund folios for most of the past year. Closed-end funds have seen inflows of Rs 1,488 crore in five new fund offers in the last two months as compared to net redemptions of close to Rs 9,900 crore in the last seven months.

But the key difference is that this money has been going into actively managed equity funds where a fund manager takes a call on the composition of the underlying equity portfolio. It's a sign that investors are willing to give the fund manager more leeway in building a portfolio.

Investors like Pankaj Kumar, a web developer from the National Capital Region, and several of his colleagues are among the many people who have invested in the new fund offers. He has been investing in actively managed funds due to their ability to grow better because the fund manager has time to focus on choosing attractive stocks at good prices. Kumar's choice of closed-end funds is because he feels that given enough time active fund management is a far better way to get exposure to stocks.

The active way

Think of active funds as you are shopping for shirts in a shopping mall. You can pick different shirts depending on their price and value to you. Similarly, active funds are managed by a professional fund manager or an investment advisor who is responsible for researching and picking different stocks, and constructing a portfolio on your behalf. A fund manager determines investing in which companies would give better returns and when it would be appropriate to buy or sell the shares of chosen companies. Through active-fund management, a fund manager tries to achieve a return higher than that of the market index.

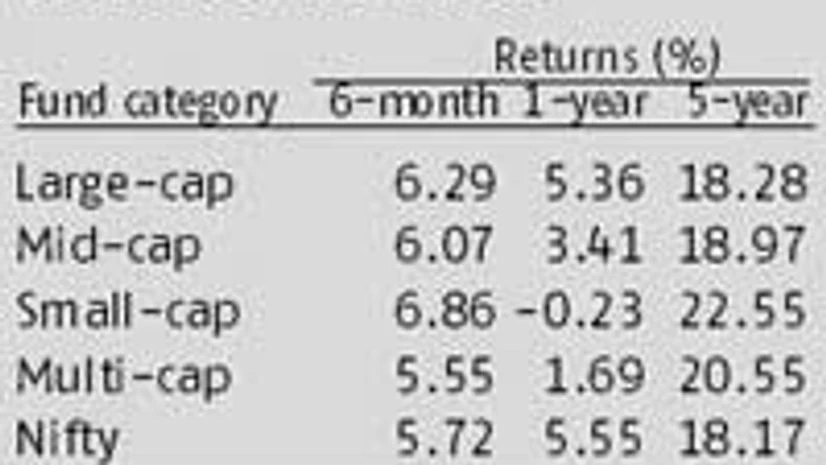

Actively-managed funds can often give returns higher than market returns. However, they can also underperform if not well-managed. A fund manager play a crucial role here as s/he decides what to buy or hold or sell, and when. Active funds in India refer to equity, debt, hybrid, income and money-market funds managed by several fund houses. There are numerous mutual funds available in the market. They can be categorized based on market capitalization size of the companies, sector, theme and asset type whether they hold equities, bonds, CDs or cash. Some popular funds are HDFC Top 200, ICICI Prudential Focused Bluechip, IDFC Premier Equity, Franklin India Bluechip, Birla Sunlife Frontline Equity, et al.

If you look at the performance of some large-cap funds, ICICI Prudential Focused Bluechip has given a return of over 24 percent in he last five years, outperforming the large-cap index by over eight percent!

The passive way

Passive funds invest in a pre-determined set of stocks much like a buying a basket of shirts that comes packaged as a hamper. Index funds have a similar portfolio composition as the indices they follow right down to the last fraction of changes. Here fund managers don't have to employ their stock selecting skills cause they just have to follow a certain indice, say like the Sensex or Nifty and buy all the stocks in a index. And they are designed to provide consistency with the market index. Very common examples are Index funds and ETFs (exchange-traded funds). These funds are low-cost investments as they don't incur the cost of fund-manager oversight and frequent sale/purchase of stocks. By investing in them, a client carries a less risky position because they purchase those securities that are part of the index.

Returns with this type of investment are usually in line with the performance of the market or any other chosen index and barely tend to exceed it. However, it does not mean that passive funds don't carry any risk at all. Any investments in equity funds, whether active or passive, always has risk attached . Passive-fund investment is less risky than investment in direct equity, though. Some other examples of passive funds are quasi-index funds, model-based index funds and quant-based funds.

For people keen to secure returns higher than a market index and are open to risking underperformance of a fund, active funds are a better choice. However, one has to ensure that the funds chosen have a good track record of performance for the last several years. Some of the commonly invested active funds are HDFC Top 200, ICICI Focused Bluechip, Franklin India Bluechip, BSL Frontline Equity, etc. One may find active investment options across market capitalisation, i.e., small-cap space, mid-cap space and large-cap space.

Passive-fund investing is suited for those who want to invest in stocks but do not want the hassle of changing their equity positions in a portfolio. Such investments carry lower costs than active funds. Such funds save much time for individuals on research and analysis. These are suited to investors who are keen to maintain equity allocation exactly as the market index. The returns do not depend on a particular sector or stock but the overall performance of all the assets that a person has invested in through them. This type of an investment is done by simply tracking the market and is ideal for people who do not want take much risk with specific stocks.

The writer is a certified financial planner

)