Buying a house? You might come across a builder who conveniently advertises one rate but quotes a different one when you go to see the flat or apartment. If questioned, the answer often is that the advertised rate was an offer that is over now. That's not all. Most builders and brokers heckle you to decide immediately, saying there are many buyers waiting to lap up the property. But once you have paid, they seldom live up to their promises. If the flat is to be delivered one year later, you would be lucky to get it after 18 months. In addition, builders keep demanding extra money for parking, extra floor space or under some other head. The worst part: Buyer-builder agreements never favour the buyer.

There are legal remedies and in recent times, the courts have aggressively penalised some leading builders for changing rates or delaying project completion. However, too long-drawn a process puts off litigants.

The Real Estate Regulatory Bill, to be tabled in Parliament in the monsoon session, is expected to have some answers for such worries.

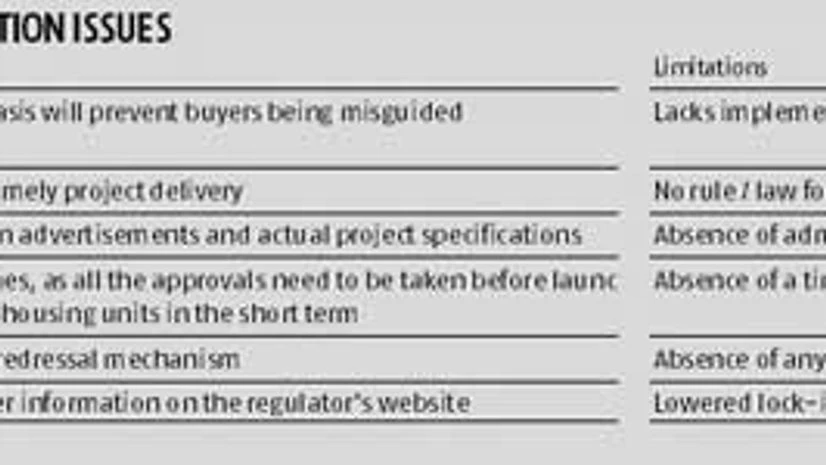

So, does the Bill offer a smoother process of buying your dream home? Does it have a better grievance redressal mechanism? According to credit rating agency CRISIL, the Bill will improve buyers' confidence and boost demand for residential real estate. It will incorporate mandatory disclosure clauses for builders, providing greater clarity on the project standards and time-lines for completion. The current form of the Bill is diluted from the draft published in 2012.

Get detailed plans

Prior to any construction activity, developers have to mandatorily register the project with the proposed regulator. This will be compulsory for all projects with a land area of 4,000 square metres or more. This stage comes after the developer has obtained all necessary clearances for the project.

Real estate experts say this clause is expected to impact developers in all major cities, except Mumbai, where the Bill will have limited impact due to smaller plot areas.

After registration, the developer will have to disclose details such as the carpet areas of all flats, layout plans, development phases, proforma of agreement, list of bookings, project architect(s) or structural engineer and so on. All this information has to be updated on the regulator's website, which will ensure transparency. This will increase consumers' confidence in buying homes, as projects will be under the regulator's purview.

"Since only bigger projects can be registered, the smaller ones will continue to remain outside this ambit," says Anil Harish of Mumbai-based DM Harish & Co. "This will widen the gap between small and big developers, leaving room for the smaller ones to indulge in wrongdoing."

No more false promises

Developers, small and big, will not be allowed to market or advertise projects without getting the necessary approvals. Similarly, no invitation or pre-launches will be allowed prior to obtaining a registration certificate.

Usually, in a pre-launch or soft launch of residential projects, a select group of buyers are given a discount of 5-15 per cent on the launch prices. "These investments carry a substantial risk, as projects at that stage might not have received all required approvals. Hence, this will restrict developers from raising cash from high net worth individuals who are willing to take the exposure," says Sanjay Dutt, executive managing director (South Asia) at Cushman and Wakefield.

The Bill seeks to protect buyers' interests by asking projects to be launched only after securing statutory clearances from the relevant authorities. The authorities will have to approve or reject projects within 15 days from the date on which the developer submits documents, which otherwise can take forever.

If a developer makes any false promises or runs misleading advertisements, it will attract a penalty. Buyers affected by misleading advertisements will get a full refund of the money deposited, along with interest, in case they wish to withdraw from the project.

The Bill suggests 10 per cent of the project cost as penalty for first-time offenders. Repeat offenders could get a jail term of up to three years.

Once builders start marketing (after receiving all approvals), they will only be allowed to use real pictures of the projects and not computer-generated visuals, which could mislead buyers.

While quick approvals are required, the Bill doesn't elaborate on the process to get these and which authorities to approach. This could be a problem area, with developers passing the buck to the authorities, saying they take time in giving approval.

"The law should be comprehensive and give role clarity to the authorities as well," adds Harish.

According to Samantak Das, chief economist and director (research), Knight Frank India, if the builder takes too long to launch projects due to delay in approvals, it could push up property prices as escalation costs are passed on to the home buyer.

Ask for clearly defined areas

The Bill directs developers to sell their properties only on the basis of the 'carpet area' of the property. Concepts like 'super area' and 'super built-up area' are not allowed.

Carpet area is the net usable floor area of a residential unit. Developers try to sell flats based on the 'super built-up area', which also takes into account common areas such as the lobby, lift shaft and stairs.

With this, buyers will get clarity on the actual livable area they will get on receiving possession of the flat. Also, buyers will know the actual usable area.

Most developers show the property construction plan with all dimensions but don't give the usable floor space. Experts say there still could be ambiguity over the actual definition and measurement standards for carpet area. Definitions in laws can be subjective and different developers can interpret the definition differently and calculate based on their own assumption.

The Bill mandates 70 per cent or less, as notified by the appropriate state government, of the funds raised for a project be deposited in a separate account. Till now, builders were supposed to put at least 70 per cent of buyers' advances in a bank account earmarked for a particular project. With this amendment, the minimum threshold of 70 per cent is gone and no new minimum threshold is given.

Developers are also required to keep 70 per cent of the money realised from sales into an escrow account towards construction costs, which cannot be used for anything else.

This will ensure developers do not divert funds meant for a particular project to other projects. The Bill also protects buyers' interest against project delays by asking developers to refund the amount paid, along with interest, in the event of a delay. Both factors are expected to ensure timely completion of projects and handover of units to buyers.

"Given the intention behind this provision (addressing project delays), the 70 per cent threshold might not be appropriate in all cases. Hence, a lower limit which considers the cost of construction till completion would serve the purpose," says Das of Knight Frank.

Usually, developers need 30-40 per cent of the cash collected for construction. So, if a lower limit than 70 per cent is not set, it will hit the viability and feasibility of the project," says Dutt of Cushman & Wakefield.

And, if a developer maintains a lower amount, it means it will have that much less money to finish the project, thus impacting the buyers. "Diluting from 70 per cent to 70 per cent and less has given decision power in the hands of the state regulator. This could lead to higher red tape in the sector," says Tejas Sheth of Emkay Global Financial Services.

And more benefits

The Bill has also proposed agents and brokers be registered. This might be difficult to implement, considering the number of brokers operating. It could be implemented in the metros but will be quite a task in smaller towns.

The Bill says the developer should repair any defects that might show up within a year of house possession. It also prohibits builders from taking any deposit or advance prior to entering into a sale agreement.

Sheth of Emkay Global Financial Services says the current Bill requires a lot more clarity and doesn't address many loopholes. It doesn't say which law the state regulator is to follow when the State and the Centre's respective Bills are at crossroads.

The Bill doesn't clarify the difference in definition of a project and its phases, as well as the time frame within which common amenities should be assigned to customers.

No official pre-launches, registration of agents would curb investor money in the sector when combined with the one per cent tax deduction at source clause introduced in Union Budget, Sheth adds.

On the whole, the Bill seeks to make the entire builder-buyer transaction more transparent. Now, implementation will be key.

)