With the launch of Bharat 22 Exchange-Traded Fund (ETF), the expense ratio of ETFs has touched a new low of 0.0095 per cent. This has revived the debate on active versus passive mutual funds (MFs) and whether it’s time for investors to look at such low-cost ETFs. The money that an investor saves in fees helps him in increasing returns on investments. Experts say investors would be better off sticking to active funds for now.

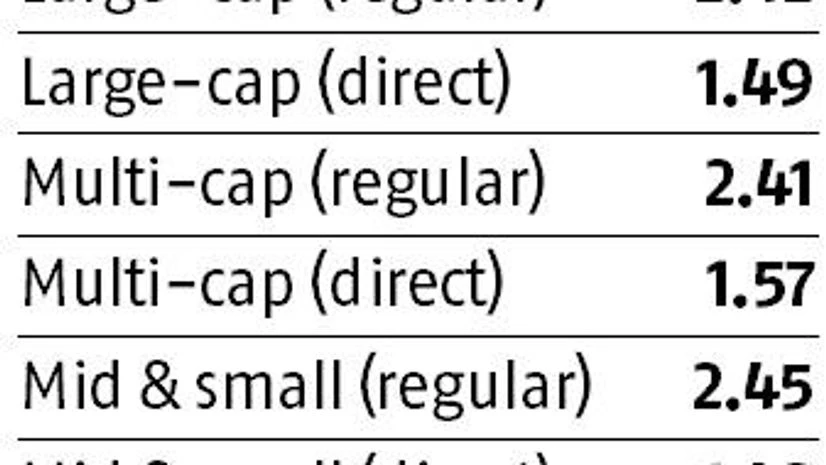

Today there are 19 ETFs with an expense ratio of 10 basis points (bps) or less. In contrast, the average expense ratio of diversified

Today there are 19 ETFs with an expense ratio of 10 basis points (bps) or less. In contrast, the average expense ratio of diversified

)