Investors are lapping up non-convertible debentures (NCDs) as interest rates are expected to decline in the future. Within two days of opening, Indiabulls Housing Finance Ltd’s (IBHFL) issue was subscribed two times — receiving bids of over Rs 7,200 crore. Earlier, Dewan Housing Finance Corporation Ltd’s (DHFL) second NCD issue worth Rs 10,000 crore was fully subscribed on day one.

“While attractive interest rates offered is one reason for the heavy demand for NCDs, many are also investing in them as any tax-free bond issue is unlikely this financial year,” said Ajay Manglunia, EVP and head, fixed income, Edelweiss Financial Services. Usually, the government makes budgetary provision for the issue of tax-free bonds, which was absent in this year’s Union Budget.

ALSO READ: Bank FDs to become unattractive?

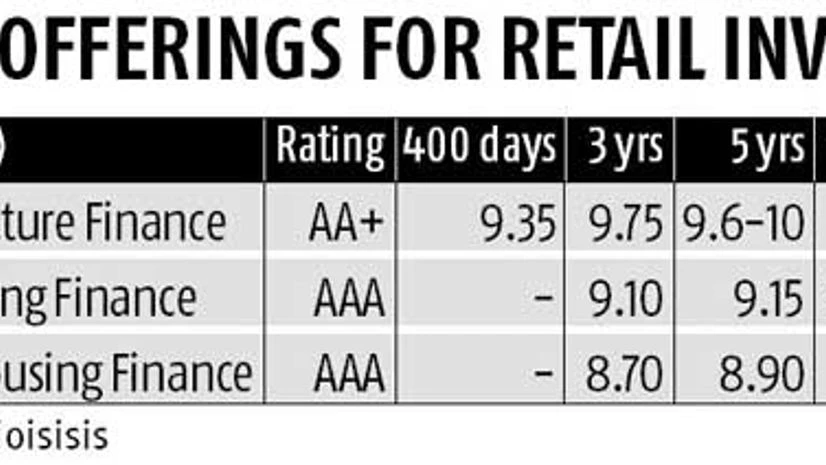

Experts feel that interest rates are likely to fall from current levels. An indication of this is the declining yield of 10-year government security (G-Sec), which is trading at 6.87 per cent, down 23 basis points (bps) within a month and 63 bps in three months.In fact, the interest rates offered on AAA-rated NCD issues have also been lowered but are still higher than rates of bank fixed deposits (FD). Retail investors in DHFL’s second tranche could earn 9.1 per cent if they invested for three years, 9.15 per cent over five years, and 9.25 per cent over seven years. IBHFL offered 8.7 per cent for three years, 8.9 per cent for five years and 8.65-9 per cent for 10 years. The State Bank of India offers an interest rate of seven per cent on its FDs of three years or more.

But wealth managers say better options than NCDs are available for both high net worth individuals and retail investors. “If you compare post-tax returns of AAA-rated NCDs and debt mutual funds, the latter work out to be better for those in the 30 per cent tax bracket,” said Sriram Iyer, chief executive officer, Religare Wealth Management.

Five-year and 10-year average returns of debt liquid fund schemes are 8.72 per cent and 7.82 per cent respectively. If an investor calculates tax using the indexation benefit, the tax outgo will be marginal. The risk in mutual funds is also lower. “In case of NCDs, the investor is exposed to a single company. In mutual funds, a fund manager holds a basket of securities from different institutions,” added Iyer.

Many HNIs are subscribing to these issues for the purpose of trading them on the stock exchange once they list. “But such strategies are not for everyone. They are suited only for wealthy investors who understand the nuances associated with trading of such instruments in the secondary market,” says Abhijit Bhave, CEO, Karvy Private Wealth.

Interest rates of NCDs are attractive for those in the 10 per cent and 20 per cent tax bracket, but they should first exhaust their public provident fund (PPF) limit before investing in NCDs, said Bhave. At present, PPF offers 8.1 per cent tax-free return. One has to also understand the risks involved in NCDs.

Bhave said if a small investor doesn’t understand such risks, a bank fixed deposit will be a better option for him. A triple-AAA rating means that the issue is one notch below instruments that have sovereign guarantee. Also, these ratings are valid for a limited time–they can change two financial years later.

There are issues that offer over 10 per cent annual returns which are rated AA+, like the current offering from Srei Infrastructure Finance. The lower ratings mean that they carry more risk than AAA-rated issues. In such a case, investors need to look at the background of the company and whether it has a track record of repayment. Only if investors understand the business and have faith in the management should they go for such issues.

Also read

https://www.business-standard.com/article/pf/company-fds-require-extra-due-diligence-116032400336_1.html

https://www.business-standard.com/article/pf/balanced-funds-good-for-first-timers-retirees-116063000107_1.html

)