The Association of Mutual Funds in India (Amfi) data show that assets of the mutual fund industry have hit an all-time high of about Rs 12 lakh crore.

AMFI said the assets under management (AUM) had reached Rs 12.02 lakh crore. Figures for the previous month showed Rs 11.8 lakh crore. Equity funds had inflows of Rs 5,217 crore, taking total inflows on a year-to-date basis to Rs 61,089 crore.

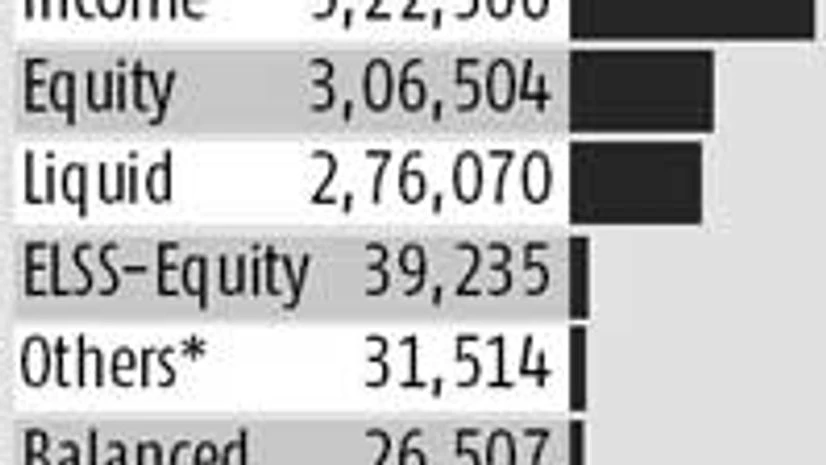

Income funds and liquid funds account for the largest proportion of AUM. Income funds account for Rs 5.22 lakh crore. Meanwhile, equity funds accounted for Rs 3.06 lakh crore. Liquid funds had assets of Rs 2.76 lakh crore. Equity linked savings schemes (ELSS), which offer tax benefits, had AUM of Rs 39,235 crore.

Equity funds had been doing well on the back of a recovery in the equity markets. The BSE Sensex, an index whose movements are seen to be representative of how the market is doing, crossed the 30,000-mark for the first time on Wednesday, and the outlook for equities remains robust, according to experts.

All categories of schemes have seen net positive inflows during the course of the year, barring gold exchange traded funds and overseas funds. Gold funds have underperformed on account of weak gold prices globally. Overseas funds have underperformed Indian equities, and adverse currency movements have also affected investor returns.

Domestic equity funds had seen outflows of Rs 5,526 crore in the same period last year, compared to inflows of Rs 61,089 crore this year. Profitability too is likely to be higher since asset managers can charge higher fees for equity funds compared to debt schemes. The Securities and Exchange Board of India (Sebi) has also allowed for an excess 0.3 per cent charge of equity funds if 30 per cent of flows are from centres outside the top 15 cities.

Inflows from regional centres have picked up say mutual fund executives. The industry has set a goal of hitting AUM of Rs 20 lakh crore by 2020.

)