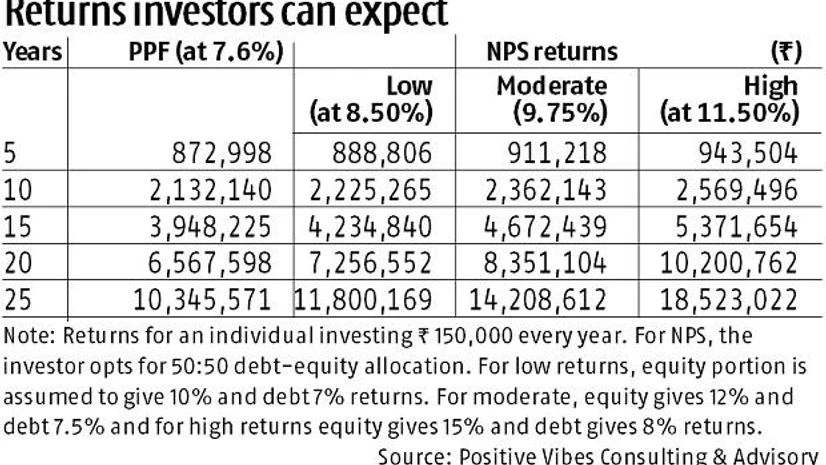

The self-employed, who have been investing primarily in the Public Provident Fund (PPF) for retirement, should now look at the National Pension System (NPS). Recently, the government has lowered interest rates on small savings schemes, including PPF, from January 1. Any contribution to PPF will now fetch an interest of 7.6 per cent, 20 basis points lower than a quarter before.

This has widened the gap between the long-term fixed-income retirement products available to the self-employed and salaried. Employees’ Provident Fund (EPF) fetched salaried individuals an interest rate of 8.65 per cent in the last financial year (2016-17). Even

This has widened the gap between the long-term fixed-income retirement products available to the self-employed and salaried. Employees’ Provident Fund (EPF) fetched salaried individuals an interest rate of 8.65 per cent in the last financial year (2016-17). Even

)