Tipping Point: Large-cap funds beating mid- and small-caps after a long gap

The bull run in any asset class does not last forever, so investors need to be well diversified

)

premium

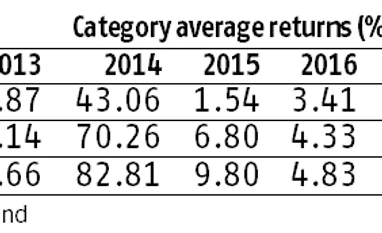

For the first time since 2013, large-cap funds are outperforming their mid- and small-cap counterparts. The turnaround in the fortune of this category underlines a few things. The bull run in any asset class does not last forever, so investors need to be well diversified.

The higher decline in mid-and small-cap funds year-to-date suggests that they are more volatile in nature. For stable returns, most investors should have 60-70 per cent of their portfolios in large-caps which invest in larger, well-established companies.

The higher decline in mid-and small-cap funds year-to-date suggests that they are more volatile in nature. For stable returns, most investors should have 60-70 per cent of their portfolios in large-caps which invest in larger, well-established companies.