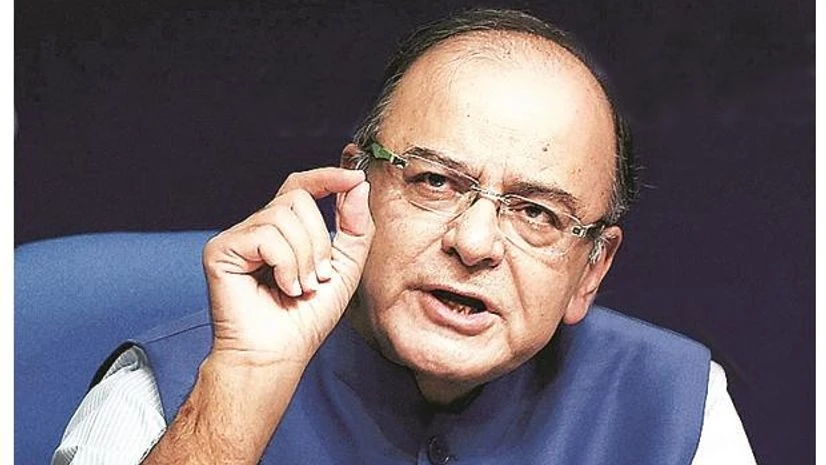

Finance Minister Arun Jaitley today said the resilience of the country's banking system is under test and banks must restore their credibility and work for the society as taxpayers are making sacrifices to keep them afloat.

Jaitley said it is taxpayers' money which is being infused into the ailing banking system and now the responsibility is on the sector to improve health to help in pushing towards a robust economy.

The minister, while addressing Uco Bank's Platinum Jubilee event here, said "the resilience of the banking system is under test", with the sector facing severe challenges.

More From This Section

He further said that it is very important for the economy to keep the banks in good health.

"The lending that the banks do is an indication how the growth will move. The last few data which came up have shown that credit growth has moved up. And once this infusion of the capital into the banks takes place, the credit growth will further move up," Jaitley said.

When credit growth picks up coupled with revival in global commodity prices, one should really visualise a better future from the the current challenges that the banks face, he added.

The country's taxpayers are making a sacrifice to keep banks afloat and it is now the responsibility of the sector to give it back to the society, the finance minister noted.

"The taxpayers in India are just not the corporates, it includes middle class, lower middle class, and all are making a sacrifice to keep you (banks) in good health. So this money which is being infused is the money which could have been used for another social purpose," he said.

The money being infused into the banking system is to make sure that the lenders are able to improve credit and better their growth prospects, he added.

"And therefore in the next few years, your performance is really on test. And I do hope that while you celebrate your platinum (jubilee) feeling, it is also should be a responsibility in terms of direction and giving back because the society through its taxpayers is keeping you revived," Jaitley said.

"And therefore it is your responsibility to come up with faster pace and much better health so that you are able to give a much robust economy as far as the country is concerned," he added.

Jaitley observed that a slowdown in several sectors had an impact on the balance sheets of the banks.

He added that two positive features are visible now although it is an extremely big challenge to restore normal situation in the banking sector.

"One is that even when the world economy had slowed down, India continued to grow at a reasonable pace...secondly, some of the sectors that stressed you, steel prices moving up, we can see a lot of movement in the infrastructure space and a lot of interest by global institutions and funds in Indian infrastructure," he said.

The government in October had announced an unprecedented Rs 2.11 trillion two-year road map to strengthen PSBs, reeling under high non performing assets (NPAs). Their NPAs increased to Rs 7.33 trillion as of June 2017, from Rs 2.75 trillion in March 2015.

The plan includes floating re-capitalisation bonds of Rs 1.35 trillion and raising Rs 580 billion from the market by diluting government's stake.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

)