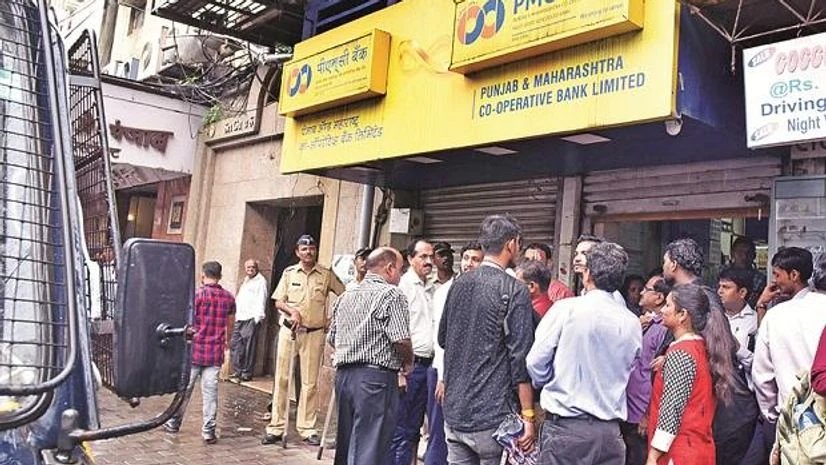

The Reserve Bank's central board on Friday discussed in detail the regulatory and supervisory architecture of commercial and cooperative banks against the backdrop of Rs 4,500 crore scam at the PMC Bank.

The meeting of the central board, held in Chandigarh, came a day after Finance Minister Nirmala Sitharaman announced setting up of a panel to recommend legislative changes to ensure better governance at cooperative banks.

Besides, the board reviewed the current economic situation, global as well as domestic challenges, and various areas of operation of the Reserve Bank of India (RBI).

"In this context, the board also discussed in detail the current state of the financial sector with special focus on the regulatory and supervisory architecture of commercial and cooperative banks as also NBFCs," the central bank said in a statement.

The NBFC sector has been facing liquidity woes and other headwinds for many months following the IL&FS fiasco last year.

Also Read

The board, chaired by RBI Governor Shaktikanta Das,

also discussed the role of payments banks and small finance banks in enhancing financial inclusion.

The annual activity reports of local boards, various sub-committees of the board and functioning of a few central office departments were also deliberated upon at the meeting.

A strategy sub-committee of Central Board of Directors has been formed, the statement said.

RBI deputy governors N S Vishwanathan, B P Kanungo and Mahesh Kumar Jain attended the meeting.

Other directors of the Board N Chandrasekaran, Bharat Doshi, Sudhir Mankad, Manish Sabharwal, Ashok Gulati, Prasanna Kumar Mohanty, Dilip S Shanghvi, Satish Marathe, Swaminathan Gurumurthy, Revathy Iyer and Sachin Chaturvedi - also attended the meeting.

Finance Secretary Rajiv Kumar and Economic Afffairs Secretary Atanu Chakraborty too participated in the 579th meeting of the central board.

)