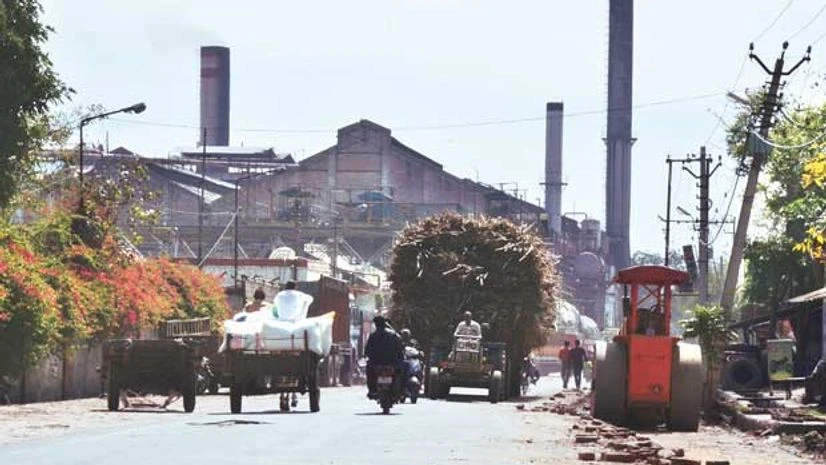

Things are finally looking up for the sugar industry. Sugar mills with low debt and large downstream facilities, such as bagasse-based electricity generation and distilleries, are earning good money at the current ex-factory prices of the sweetener.

Even mills, which had raked up huge loans to tackle a fall in sugar prices below cane cost, are breaking even. A likely further good run in sugar price realisations will enable these large mills to put their house in order by way of paring debts and building capacities to realise better value from cane residues.

The business architecture of companies such as Balrampur Chini in the north and Bannari Amman in the south is such that even when sugar prices are in the dumps, their downstream units are able to generate decent earnings. In good times, like the present, their profits usually surge. Already, the shares of many sugar companies have more than doubled from the levels seen last year.

Another sign of despair of earlier days giving way to confidence among sugar producers is Balrampur Chini’s announcement last month of an interim dividend of 350 per cent for 2016-17.

Supply-demand mismatch

Forecast of a large world production deficit in the season starting next month due to consumption running ahead of output in 2015-16 has pushed sugar prices to four-year highs. The 2016-17 deficit is likely to climb to 7.05 million tonnes (mt) from an estimated 5.7 mt in the current season that will end this month.

Reports of a fall in world inventories of sugar could translate into prevailing October futures price at Intercontinental Exchange in New York of about 22.30 cents a pound of raw sugar running further. What is to further fan this bullish sentiment is that the intergovernmental agency, International Sugar Organisation’s (ISO) forecast of world production rising 2.17 million tonnes (mt) year-on-year to 168 mt in 2016-17 may prove to be too optimistic.

India, for example, may struggle to meet its target of 24.5 mt. “Thanks to shrinkage in areas in Maharashtra and Karnataka, the country’s production next season will be around 23.3 mt against this year’s 25.1 mt,” says former president of Indian Sugar Mills Association Om Prakash Dhanuka.

The drop in acreage is largely due to severe dry weather in Maharashtra and Karnataka during the earlier two seasons.

According to Dhanuka, this “very low world production growth is to be seen in the context of ISO forecast of global sugar consumption rising by 3.5 mt to 175.1 mt in 2016-17. What principally moves world sugar prices is the stocks-to-use ratio which, according to ISO, will be down by 4.9 points as the next season progresses to 43.2.”

This is a clear indication that there still remains scope for sugar prices advancing further. Pointing out that this will be the lowest stocks-to-consumption ratio since 2010-11 season, ISO says “it is also below the seemingly critical level of 45 per cent which triggered a surge in raw sugar prices above 24 cents a pound” a few years ago.

As factories in India now realise more from sales than the production cost of sugar, they have moved into a position to rapidly settle dues on account of cane supplied by farmers. Cane dues, which shot up to Rs 21,000 crore in April 2015, causing untold misery to millions of growers, are now down to Rs 4,000 crore.

The improvement in prices has saved sugar factory accounts from turning into non-performing assets for banks. Industry borrowings from banks and the government are down from last year’s Rs 64,000 crore to about Rs 50,000 crore.

No shortage here

What is comforting for all stakeholders is that in spite of expected production fall of 1.8 mt in 2016-17, the country is unlikely to experience shortages of sugar at any point during the season. The forthcoming season will open with stocks of 7.5 mt against earlier estimate of 7 mt and the total availability during 2016-17 will be 30.8 mt against expected internal demand of 25.6 to 25.8 mt. But what about 2017-18 when the season will open with around 5 mt? Ideally, the country should open a season with inventories that are good for two and a half months. The reason for this is sugar production starts in full throttle only in December.

Since 2017-18 will start with a much finer inventory than in recent years, the government will do well to waive excise duty on incremental production in October and November over the corresponding period of 2016-17 to avoid tight supply leading to sudden rise in prices.

The real challenge is to improve the sustainability of the industry. According to ISMA Director General Abinash Verma, time is now opportune for the government to make suitable amendments to the Sugar Cane (control) Order, 1966, to usher in a formula linking the cane price with revenues from sugar and its primary by-products based on the ratio of their relative costs.

)