The government has set April 1, 2017 as the target date for introducing the goods and services tax, even as it said there are challenges to meet it. GST may improve ease of doing business and bring down prices in the long run though much of it would also depend on the rates that are yet to be decided, it said.

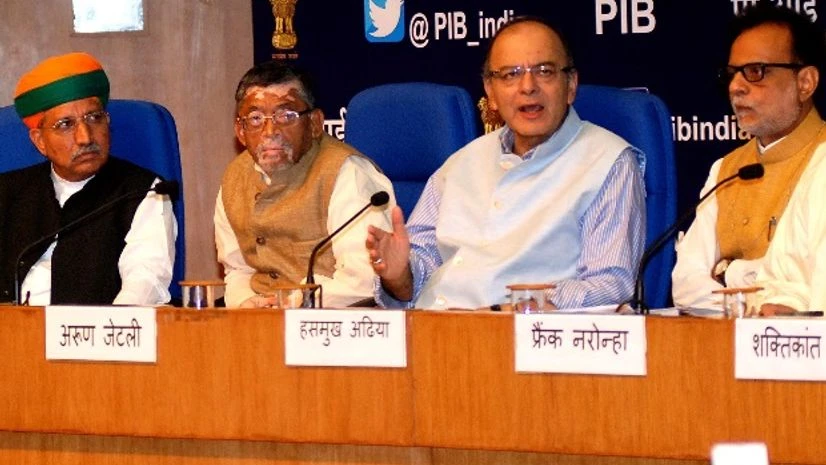

Addressing a press conference a day after the Rajya Sabhha passes the much-awaited Constitution amendment Bill, Finance Minister Arun Jaitley said the government has given notice to table the changes to the Bill in the Lok Sabha, which has already cleared the earlier version of the Bill.

He said the Bill will go to 29 state assemblies whose monsoon sessions are on currently. The states where the session is not on can call special session, he said.

In a presentation, Revenue Secretary Hasmukh Adhia said the target date for GST roll out is April 1, 2017.

To a query over this, Jaitley said, "We are going to try to make it as reasonably quick. Which is a date is yet to be seen," he said.

Also Read

However, he also added that setting target is better than having none.

Adhia spelt out seven challenges that the government has to address to meet the deadline.

These include calculation of revenue base of Centre and States, along with compensation requirements of Centre, GST rates structure, list of exemptions, forming of consensus on model GST Bill, threshold limits, compounding limits and avoiding dual control over scruity and assessment.

The finance minister said once GST is rolled out, ease of doing business would improve in the country and in long run the tax rate would also come down. "It is obvious that many items may see reduction in prices," he added.

However, to a query that the countries who have introduced GST saw rise in inflation initially, he said,"there is no settled model in this regard."

He said all this would also depend on the GST rates and slabs, a decision which is yet to be taken by the GST council.

When asked about the 18% tax rate which the Congress demanded based on the chief economic adviser Arvind Subramanian report, he said CEA had suggested rates in the range of 16.9-18.9%, which when rounded off becomes 17-19%.

"This 18% has been thrust on CEA," he said.

The finance minister said 60-70% of items attract 27% tax, including Central and states. If cesses, surcharges and local taxes are also included it goes up to at least 30%. Now, Empowered Committee of state finance ministers, he said had resolved to bring down GST rate from this level. However, the rate should also meet the states development goals.

This balance will be decided by the proposed GST council, he said.

)