Even as mass digital viewership picks up on smartphones, Indian over-the-top (OTT) players like Hotstar and Eros Now have set their sights on the paying customer who wants a premium viewing experience. For this, companies are working out content plans that offer customers exclusivity and focusing on improved production values. Even global OTT players, Netflix and Amazon Prime (expected to launch its services in the country sometime soon) are hunting for value over volumes as they tie up exclusive content deals and produce shows that cater to local tastes. However, given that paid viewing is still largely an urban phenomenon and the premium experience that OTT players are promising, heavily dependent on the penetration of smart devices, it may be some time before the digital broadcasters hit pay dirt.

According to the companies, while the widespread use of mobile phones has helped build a mass viewership, the large screen is emerging as the channel for growing premium (paid) membership. Ajit Mohan, CEO – digital, Star India says, “As more and more people have access to broadband, (this is clearly the more affluent, top end of the market) they’re also starting to adapt to the habit of watching OTT content on larger screens.” His app is now available on Apple TV as is Eros Now and Netflix. Eros Now offers a premium service for ~99 a month and has a ti-up with Trinity Pictures for original and exclusive digital content.

Mohan believes that the increasing adoption of connected TVs and smart TVs among urban households gives OTT players the headroom to grow premium services. Also with growing exposure to global shows and the entry of global OTT players, many urban homes have invested in devices and broadband services that ease the streaming of high definition content. This has the potential to push premium subscription because, the OTT brands believe, these viewers are not averse to paying for what they watch on these screens.

Mohan says, “People have access to very high speed broadband now at least in the Delhi, Bengaluru, Mumbai, Hyderabad belt. People are spending money and buying smart TVs whether it’s an Apple TV or Chrome Cast. These two factors are helping move on-demand consumption of content from the mobile to the large screen.” Hotstar is available on Apple TV and on the Chrome Cast service. Mohan says that it will be launched on Amazon Fire as and when the service comes to India. Among the other OTT apps that are doing the same are Netflix, Spuul, Eros Now and Yupp TV.

Hotstar says it has innovated with the premium service not only in terms of a content library (it has exclusive deals with Hollywood studios like Fox and HBO), but also provides Indian shows hours before the local telecast on TV. A similar strategy is at play at Eros Now too. The reason the OTT players are customising their content strategies to cater to what is still a small band of viewers is that they see immense potential for growth in this segment.

“A disproportionate size of our premium audience watches Hotstar on the large screen; typically those who have access to 4 to 10 MBPS or more broadband speeds. In the last six weeks, the watch time on the large screen has doubled on Hotstar. This is fairly massive growth,” he adds.

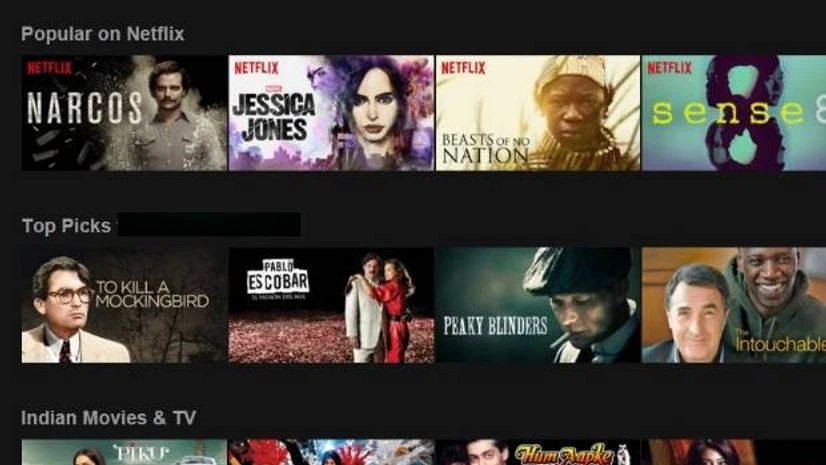

India is currently a focus market for domestic and international OTT players. Netflix launched in India in January this year followed by the launch of Viacom18’s OTT app VOOT in March. For Netflix, India was part of a global launch when it entered 130 additional countries sometime back. “We are now nearly a year into our global launch and we are pleased with how consumers in India are discovering Netflix. While we don’t share country-specific member data, we started 2016 at 75 million members and in Q3 2016, we reported 86 million members. We’ve seen that our early adopters are usually consumers who are digitally-connected and tech savvy. We find that consumers like the fact that on Netflix one can pay a flat-fee to watch as much, anytime, anywhere, on nearly any Internet-connected screen. They also enjoy being able to play, pause and resume watching, all without commercials or commitments,” Netflix informed in an email response.

Netflix is also available on connected devices and has seen a lot of growth in international markets on the large screen. In fact, internationally, a chunk of Netflix’s subscribers consume the service on the large screen via connected devices. The American giant will now be focusing on local acquisitions and productions in order to grow its share in the country.

“We recently partnered with Phantom Films to make our first original series out of India, Sacred Games, based on the popular book. On the local front, we are pursuing recent Bollywood titles, notable indie films, memorable classic Bollywood titles and the best of regional cinema (Tamil, Gujarati, Punjabi, Marathi),” the company added. Since Netflix is a paid for service, building a library that boasts of exclusively developed local content is the best way to build its brand. As homegrown brands do the same, the battle for the remote is set to get even more interesting in 2017.

)