Finance Minister Arun Jaitley on Monday presented a Budget focused on the rural sector for which he increased allocations for many schemes, even as he stuck to the fiscal deficit target of 3.5 per cent of gross domestic product (GDP) for 2016-17.

To meet this target, he will have to depend as much on non-tax revenues and capital receipts as much as he will count on taxes and the various cesses that he announced.

Read our full coverage on Union Budget 2016

Read more from our special coverage on "BUDGET 2016, FISCAL DEFICIT"

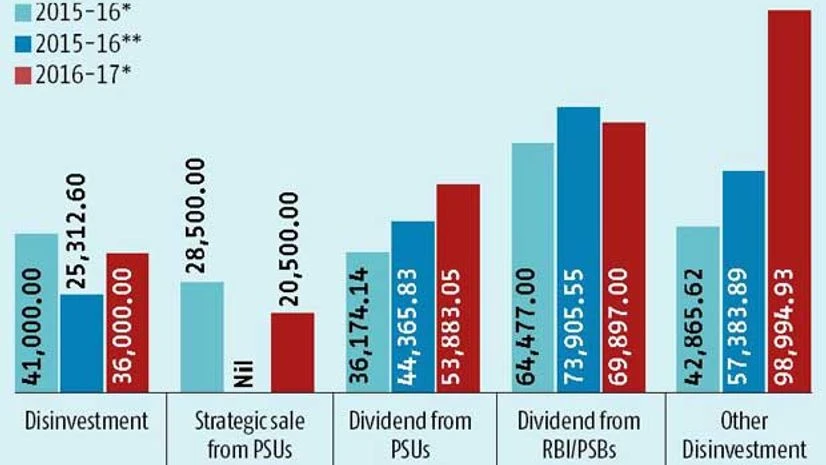

The combined Budget Estimates for non-tax revenue and non-debt capital receipts for 2016-17 is Rs 3.9 lakh crore, compared with 2015-16 Revised Estimates of Rs 3 lakh crore.

Among the major heads under non-tax revenue, the government is expecting higher proceeds from dividends from state-owned companies and strategic sales.

It is also expecting much higher proceeds from spectrum sales for a year in which its spending burden has been compounded by the recommendations of the Seventh Pay Commission and One Rank One Pension.

Also, the worsening situation with non-performing assets and their impact on bank's bottomlines means reduced profitability going ahead and that means lower dividends.

The strategic sales could range from the government selling a few units or facilities of a public sector company (PSU) to private investors to offloading a loss-making PSU outright.

"A new policy for management of government investment in CPSEs, including disinvestment and strategic sale, has been approved. We have to leverage the assets of CPSEs for generation of resources for investment in new projects," Jaitley said.

"We will encourage CPSEs to divest individual assets like land, manufacturing units, etc. to release their asset value for making investment in new projects. The NITI Aayog will identify the CPSEs for strategic sale," he added.

The finance minister also said that the government will adopt a comprehensive approach for efficient management of its investment in CPSEs by addressing issues such as capital restructuring, dividend, bonus shares, etc. To that end, Jaitley said that the Department of Disinvestment is being re-named as the "Department of Investment and Public Asset Management (DIPAM)".

According to the policy statement issued on the newly-named department's website, the various administrative ministries will assist NITI Aayog in identifying such companies or their assets.

The ministries will also make inventories of the assets, carry out their valuations and lay down clear timelines for the selling of such PSUs or assets. The NITI Aayog, on its part, will also advise the government on the mode of sale and percentage of shares to be sold.

There will also be an inter-ministerial evaluation committee to review the valuations, process documents for inviting bids, carry out the bid process and also recommend to the core group on disinvestment (CGD) the final sale price as well as the private sector buyer or partner.

The CGD, comprising senior bureaucrats from across ministries will make the final recommendations to the cabinet on such sales.

)