By Divya Patil

Billionaire Anil Agarwal’s Vedanta Resources Ltd. is on a quest for cash. The junk-rated mining conglomerate has approached investors to restructure about $3 billion worth of bonds due in 2024 and 2025, while splitting its sprawling group to unlock better value for individual businesses. But debt investors aren’t convinced, and the group’s dollar bonds are tumbling.

What is the plan for overhauling the group?

Indian unit Vedanta Ltd. last week approved a plan to separate its business into six listed companies: aluminum, oil and gas, power, steel and ferrous, base metals and an incubator for new businesses including semiconductors. The reorganization is meant to give investors direct exposure to a business of their choice and improve the value of the group’s component parts.

A streamlined structure could also help Agarwal sell unprofitable or low-growth assets — something the billionaire has long avoided.

Vedanta expects to complete the transaction by the financial year ending March 2025.

More From This Section

What’s the state of Vedanta’s finances?

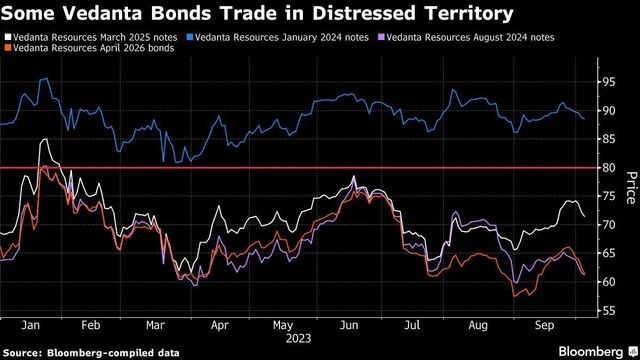

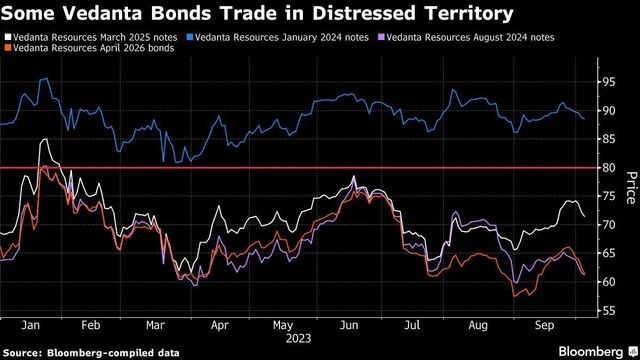

The conglomerate has bond repayments of $3.2 billion coming up over the next two years. About $2 billion of notes are to be redeemed in 2024 — half of which is due as early as January — and another $1.2 billion in 2025, data compiled by Bloomberg show.

Company representatives have proposed to pay back a portion in cash, with the remainder of the principal deferred for three years from the original due date. The plan has met with some opposition.

In order to pay back bonds, Vedanta Resources also started talks with lenders such as Cerberus Capital Management LP for a private loan of $1 billion. But the proposal to split up Vedanta Ltd. has complicated the effort.

Moody’s Investors Service and S&P Global Ratings have already downgraded Vedanta Resources deeper into junk.

What’s Agarwal saying?

The Vedanta Chairman told CNBC-TV18 on Tuesday that the group had lined up money for repayment of the 2024 bonds and that an announcement was due soon. If the terms were favorable, Vedanta would refinance the debt, he said. “But we are also looking at whether we can pay from our side.”

What’s the market saying?

While equity investors gave the demerger plan a thumbs up, Vedanta’s dollar bonds have tumbled. Of the four notes, three are trading below the 80 cents-on-the-dollar mark typically considered distressed.

)

)

The split off doesn’t immediately address Vedanta’s maturing overseas bonds. The group has yet to provide details on how exactly its debt will be spread under the new structure, or how shares currently being used as collateral will be treated. Vedanta Resources has pledged virtually all of its majority holdings in both Vedanta Ltd. and Hindustan Zinc Ltd., according to exchange data.

“The consolidated debt across all its proposed entities will still remain the same,” according to CreditSights analysts led by Lakshmanan R. “We remain concerned that the precarious debt situation at Vedanta Resources is still unaddressed.”

How did the company become such a big player?

Agarwal, who was raised in the Indian state of Bihar, took over his father’s business making aluminum conductors in the 1970s, and then branched into trading scrap metal.

He built Vedanta Ltd. through a series of ambitious acquisitions: In 2001, Agarwal bought a controlling stake in then government-owned Bharat Aluminium Co. and he followed that up with the purchase of another state-run firm, Hindustan Zinc. He successfully bid for iron ore producer Sesa Goa Ltd. in 2007 and for Cairn India. Vedanta Resources also owns copper and zinc operations in Africa.

The company was the first in India to list in London back in 2003, before Agarwal took it private 15 years later when his now known Vedanta Inc. bought out minority investors as part of efforts to streamline the group’s structure. Agarwal has renamed Volcan Investments Ltd. to Vedanta Inc.

It is this acquisition spree that led the conglomerate’s debt to balloon. Vedanta Resources’ total debt stood at $6.4 billion at the end of June.

Will the demerger go through?

The plan, which hinges on multiple government and regulatory approvals, is “far from a done deal,” Standard Chartered’s Head of Asia Corporate Credit Research Bharat Shettigar wrote in a note.

Vedanta Ltd. will follow the rules as prescribed by the corporate and tax laws while it allocates debt to demerged businesses, Ajay Agarwal, president for finance, said in an investor conference call last week. The firm will consult the lenders during the process, he said.

What are the next milestones?

An implementation timeline indicates that lenders will weigh in on the plan late this financial year, with a filing to the National Company Law Tribunal envisioned by the end of 2023. The NCLT order is due to be received in July, with the listing of the new subsidiaries in September.

As for payments, Vedanta Resources’ 2026 bond has an interest due on Oct. 23, according to Bloomberg-compiled data.

)