The Reserve Bank of India’s (RBI) six-member monetary policy committee (MPC) decided to keep the policy repo rate unchanged at 6.5 per cent for the fourth consecutive meeting, and also maintained its GDP growth and inflation forecasts for 2023-24. These decisions were expected, but the central bank caught bond street off guard on Friday with talks of open market sales of bonds at a time when liquidity is in deficit mode.

Open market operations (OMOs) by selling bonds to withdraw money will further tighten liquidity conditions. The yield on the benchmark 10-year government bond jumped 12 basis points to close the day at 7.34 per cent -- the highest in seven months.

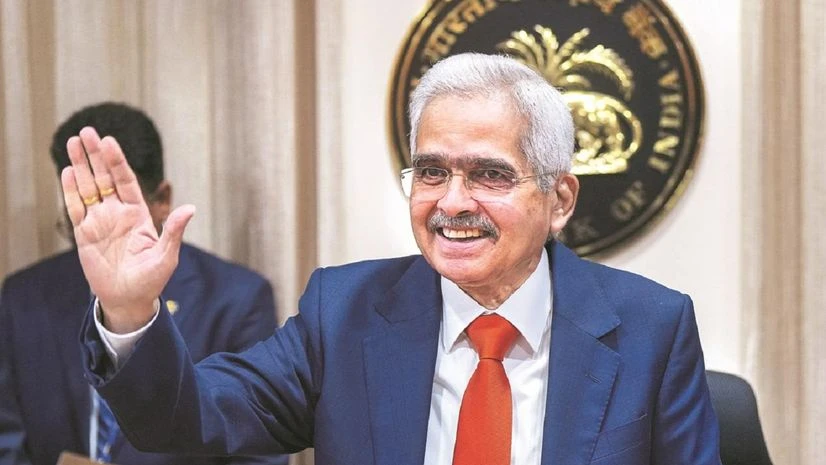

“Going forward, while remaining nimble, we may have to consider OMO sales to manage liquidity, consistent with the stance of the monetary policy. The timing and quantum of such operations will depend on the evolving liquidity conditions,” said RBI Governor Shaktikanta Das, while announcing the monetary policy review.

Commenting that excessive liquidity can pose risks to price and financial stability, Das stressed: “The monetary policy has to be in absolute readiness to take appropriate and timely action to prevent any spillovers from food and fuel price shocks to underlying inflation trends and risks to anchoring of inflation expectations. These are non-negotiable necessities.” Despite retail inflation easing in August, it remained above the central bank’s upper tolerance zone of 6 per cent.

September headline inflation is expected to fall further. The RBI governor noted the recent fall in core inflation, which he termed as a “silver lining”.

Das denied that the OMO sale plan is due to the inclusion of Indian government securities in the JPMorgan emerging market bond index, which is estimated to attract inflows upwards of $20 billion. Bond yields were expected to soften due to these inflows, apart from bond maturities that will cut the net borrowing number below Rs 4 trillion in the second half of 2023-24.

More From This Section

“It (OMO) has nothing to do with the bond index inclusion… It’s part of our domestic liquidity management,” said Das. He ruled out any OMO calendar.

He said liquidity went into deficit mode due to advance tax and GST collections in September. “There is a substantial amount of liquidity which has built because of the withdrawal of Rs 2,000 notes. Government spending is also now picking up, (and) that will also add a lot of liquidity in the system,” the RBI governor said.

The OMO talk created uncertainty in the market as the RBI intends to retain flexibility in its liquidity management. “…the threat of an OMO sale to manage liquidity – sent a hawkish signal overall. It has retained the option to act on both rates and liquidity, but there is uncertainty over what will trigger its usage. This creates elevated uncertainty for market participants but gives the RBI greater flexibility to act (or not act),” Nomura said in a note.

Analysts said the central bank would want overnight rates above the repo rate and would act if it drops below 6.5 per cent. “…we believe that the focus will be on trends in the interbank call rate. As such, if it were to drop below the repo rate, we would expect the RBI to take up measures to withdraw liquidity from the system so as to ensure the call rate remains at or above the repo rate,” Morgan Stanley said in a note.

Five members of the rate-setting panel voted to continue with the withdrawal of accommodation stance. Das said that transmission of the 250 basis points repo rate hike between May 2022 and February 2023 was still incomplete and hence the MPC decided to remain focused on withdrawal of accommodation.

“Only when we are convinced that there is durability…inflation is at 4 per cent or below 4 per cent on a durable basis that may call for re-think but not at the moment,” he said when asked what it would take to lower the repo rate.

The central bank expressed confidence on growth front and retained FY24 forecast at 6.5 per cent, and 6.6 per cent for Q1 of 2024-25. The inflation forecast for FY24 has also been retained at 5.4 per cent, and 5.2 per cent for Q1FY25.

)