By Subhadip Sircar and Anup Roy

India’s year-old campaign to boost the rupee’s role in cross-border payments has made little headway, according to people familiar with the matter, underscoring the challenges for countries trying to reduce their dependence on the dollar.

India’s year-old campaign to boost the rupee’s role in cross-border payments has made little headway, according to people familiar with the matter, underscoring the challenges for countries trying to reduce their dependence on the dollar.

The Reserve Bank of India has allowed more than a dozen banks to settle trades in rupees with 18 countries since last year and is encouraging big oil exporters such as the UAE and Saudi Arabia to South Asian nations to accept the Indian currency for trade settlements.

But success has been elusive so far with total local currency trade volumes negligible at around 10 billion rupees ($120 million) since the project started, according to people familiar with the matter, who didn’t want to be named as the figures aren’t public. That compares with India’s total goods trade of $1.2 trillion in the last fiscal year.

A Finance Ministry spokesperson didn’t revert to an email seeking comment.

The moves to take the rupee global are closely entwined with Prime Minister Narendra Modi’s aspirations for a bigger global heft for India as it posts one of the world’s fastest rates of economic growth and positions itself as an alternative to China in manufacturing in the post-Covid era.

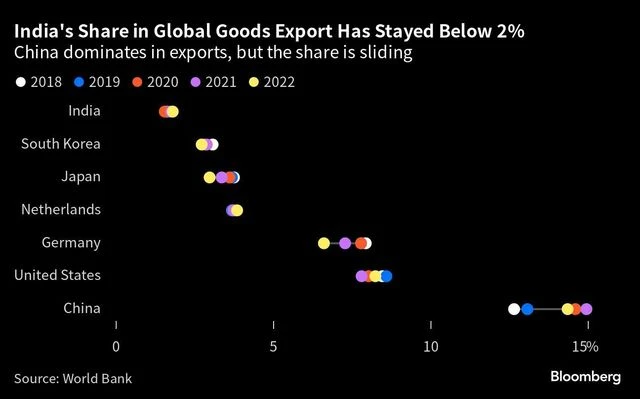

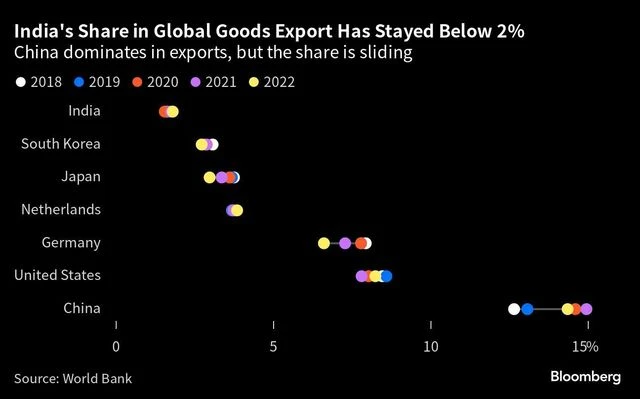

While India is betting on the internationalization of the rupee to reduce dollar demand and make its economy less vulnerable to global currency shocks, some of its policies run counter to those goals. Asia’s third-biggest economy still has capital controls and maintains a tight grip on the currency, while a chronic current account deficit and a smaller share of global exports — around 2% — are other impediments.

“The rupee’s prospects of becoming a significant international currency are connected to India’s economic and geopolitical strength but also the openness of its capital account and the quality of its financial markets,” said Eswar Prasad, professor at Cornell University and author of The Dollar Trap.

)

)

More From This Section

The challenges became more apparent recently as India struggled to pay for a surge in cheap Russian oil imports in rupees. Moscow accounted for almost half of India’s oil imports in May, from less than 2% before the invasion of Ukraine, according to data from analytics firm Kpler.

Russia was unwilling to accept rupees due to exchange-rate volatility, preferring the yuan or United Arab Emirates dirham. But a lopsided trade relationship between the two countries has forced it to accumulate up to $1 billion each month in rupee assets that remain stranded outside the country.

To deal with surplus rupees, India has suggested foreign countries invest in its government bonds and bills.

But New Delhi has also been cautious in opening up its markets. Most recently, it refused to give tax exemptions for trading on international bond platforms that would have made it easier for India’s inclusion in global debt indexes. Earlier, it withdrew a plan to issue sovereign bonds in overseas markets.

Also Read: RBI panel suggests steps for globalisation of rupee, inclusion in IMF's SDR

Also Read: RBI panel suggests steps for globalisation of rupee, inclusion in IMF's SDR

“Internationalization is a process – we don’t look upon it as an event or a target that has to be reached by a particular date,” RBI Governor Shaktikanta Das said in an interview to the Central Banking magazine published last week.

China Comparison

India’s efforts at pushing rupee payments for trade has drawn inevitable comparisons to China’s attempts to internationalize the yuan. The country is seen as a counterweight in the Indo-Pacific by the United States to China’s growing influence.

Its move also mirrors the backlash that is brewing against the hegemony of the US dollar. Brazil and China recently struck a deal to settle trade in their local currencies, seeking to bypass the greenback in the process. Even France is starting to complete transactions in yuan.

)

)

Yet, it would be wise to note the differences, not least China’s much bigger sway in global finance. The Chinese yuan had the fifth biggest share as a global payments currency in May at 2.5% while the rupee doesn’t even fare in the top twenty, as per the latest Swift data. In terms of global forex turnover, the yuan has a 7% share versus rupee’s 1.6%, according to the latest Bank for International Settlements survey.

Still, for India, the benefits are not difficult to gauge. It mitigates currency risk for Indian businesses, reduces the need for maintaining large forex reserves as well as making it less vulnerable to external shocks.

Global Funds Cling to Bullish India Bond Bets Despite Higher Tax

“India is not aspiring to make the rupee a reserve currency,” Usha Thorat, former deputy governor at RBI, said in an interview to Bloomberg Television. “India is trying to make the rupee easier to be a currency of transaction and payments.”

Yet, it may be too early to write off India’s attempts to carve out a bigger role for its currency. The country is expected to be the second biggest contributor to global growth through 2028, according to the International Monetary Fund.

And an RBI report Wednesday — which didn’t represent an official view but still contained recommendations for the country’s leaders — pointed to steps they should take to push for more international use of the rupee.

“The view is that the potential share gain for the rupee as a medium of transaction is higher than as a reserve currency in the medium-term,” said Leonard Kwan, a Hong Kong-based money manager at T. Rowe Price Group Inc. “A more open capital account, with a large and liquid pool of investible assets would be one of the things to look for toward facilitating a potential eventual role as material reserve currency.”

)