Often, women focus so much on caring for others that they overlook their own health. It's crucial for every woman, whether she's single, a stay-at-home mom, married, or working, to have proper insurance coverage. This is not just about safeguarding health; it's also about financial security and peace of mind. Fortunately, more and more women are now recognising the importance of their health and well-being, as seen in recent trends in health insurance coverage.

A report by Policy Bazaar reveals a 40% surge in health insurance coverage among women in FY'24 compared to FY'23.

Here's what the numbers reveal

A report labelled Women's Health Insurance Trends FY'23 Vs FY'24, shows a spike of 43% in the number of women opting for standalone coverage for themselves.

The data shows a rise from 15% to 24% in women selecting coverage higher than Rs 25 lakh, coupled with a 7% decrease in those opting for lesser sums.

The democratisation of healthcare access is further evidenced by a 10.5% surge in policyholders from Tier-2 cities and a 4.3% growth from Tier-3 cities, breaking the urban-centric barriers and extending benefits to previously underserved areas.

More From This Section

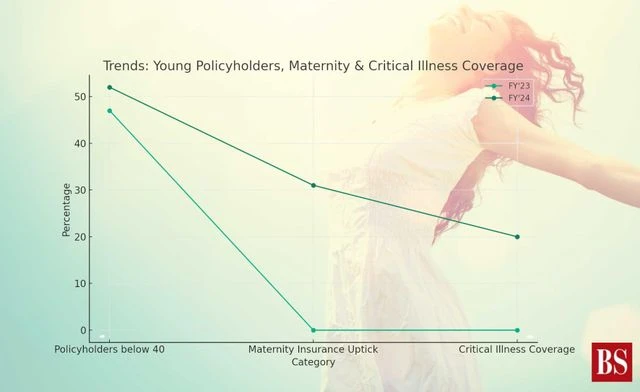

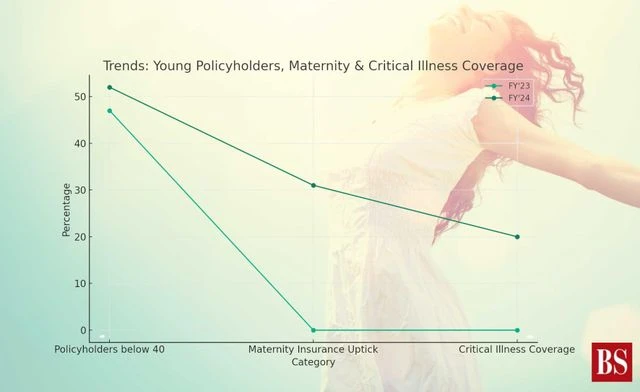

Younger women under 40 now represent a larger share of policyholders, increasing from 47% to 52%.

This trend is consistent across all age brackets below 50, although there's a noted decrease in coverage among older age groups.

Maternity insurance and critical illness coverage have seen substantial upticks of 31% and 20%.

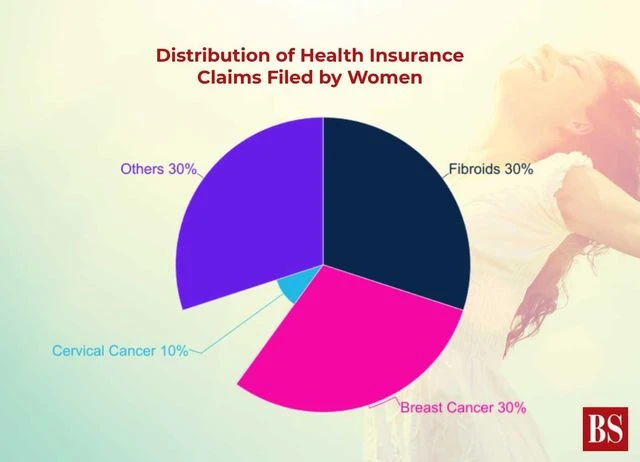

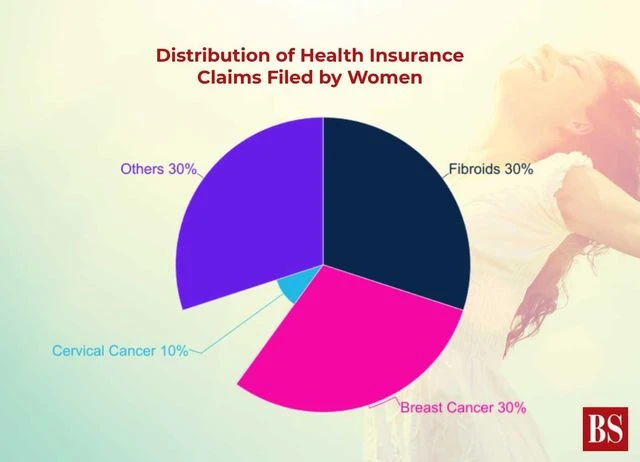

The rate of claims filed by women has increased by 25%, with fibroids, breast cancer, and cervical cancer being the most common reasons, emphasising the importance of tailored coverage and specialised care.

)

)

A notable increase in women opting for preventive care services—from 10% to 20%—signifies a shift towards proactive health management and the significance of early detection and prevention.

)

)

)