Footfall, enquiries, and bookings at car dealerships are rising, driven by attractive offers and promotions. These special deals typically start in October and run until the New Year.

“Many companies pay Diwali bonuses to employees, boosting purchasing power and consumer sentiment,” says Raoul Kapoor, co-chief executive officer (CEO), Andromeda Sales and Distribution, a loan distribution network.

Besides negotiating a good deal on the car, buyers must secure a favourable loan offer.

Festive offers

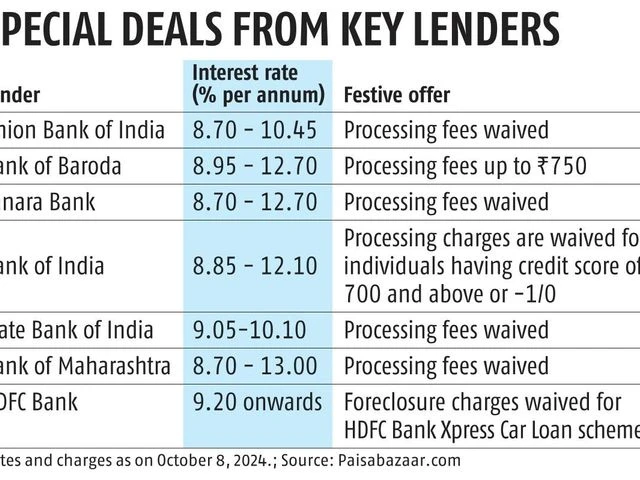

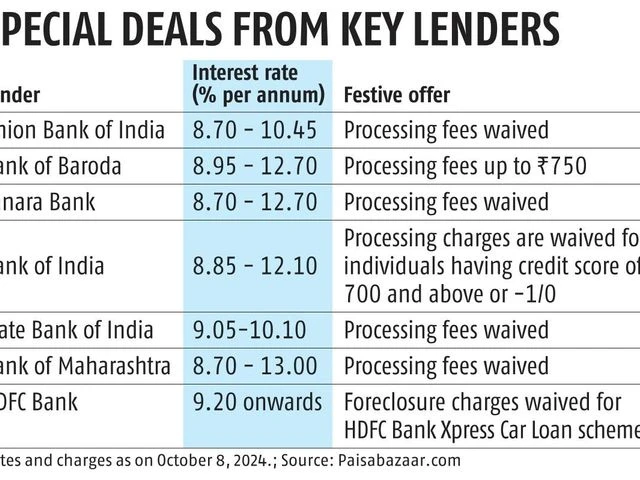

Many banks are offering lower interest rates and waiver of processing fees. Some have waived the foreclosure charge (see table). The key question for customers is how much these offers should influence purchase decisions. While festive offers may sweeten the deal, experts advise evaluating the overall loan terms. “Beyond the perks, review the interest rate and loan tenure, and check for hidden fees,” says Kapoor.

Interest rate

More From This Section

Compare interest rates offered by various lenders. “Tailor-made schemes may offer significant repayment flexibility, with comfortable equated monthly instalments (EMIs). However, they will not compensate for a higher rate of interest. Even if the loan tenure is two to three years, a higher interest rate can negate the benefits,” says Adhil Shetty, chief executive officer (CEO), BankBazaar.com.

Consider whether to opt for a fixed or floating-rate loan. Lenders may offer fixed-rate loans at lower interest rates with no prepayment charges. “But the fixed rate will only be cheaper if interest rates remain stable or rise during the loan tenure. If rates fall, a fixed-rate loan could be more expensive,” says Shetty. Rates are more likely to fall in the near future.

)

)

Loan tenure

Lenders usually offer loan tenures of up to seven years. “A longer tenure reduces EMIs but increases the total interest cost, and vice versa,” says Sahil Arora, chief business officer (secured loans), Paisabazaar.

However, avoid EMIs that are too high. “Do not overstretch your budget,” says Kapoor.

Shetty suggests striking a balance between the loan tenure (and hence the total interest cost) and the EMI.

Loan-to-value (LTV) ratio

This is the percentage of the vehicle’s total cost the lender is willing to finance. The balance, known as the down payment, must be paid by the customer. Younger customers often prefer higher LTVs due to difficulties in saving for a downpayment.

“Lenders set the LTV ratio primarily based on their credit risk policies and the loan applicant’s credit profile,” says Arora.

Kapoor recommends avoiding 100 per cent financing, as making a down payment reduces interest cost. “A car is a depreciating asset, so keeping acquisition costs low is better. Only borrow what’s necessary. If your funds are invested in instruments that offer returns much higher than the car loan rate, and you don’t want to liquidate them, only then go for a higher loan,” says Shetty.

Smart tips

While festive offers can reduce costs, borrowers should also consider the lender’s transparency and service quality.

Customers need to be mindful of their repayment capacity. “Most lenders prefer applicants whose sum total of EMIs remains within 50-60 per cent of their monthly income,” says Arora. Kapoor warns against rigid loan terms and unnecessary add-ons that inflate the loan amount. He adds that ignoring prepayment penalties and not reading the loan agreement are mistakes borrowers should avoid.

)