The share of senior citizen term deposits have doubled in the last five years to 30 per cent in fiscal year 24 as many have locked in their savings at higher interest rates before the Reserve Bank of India (RBI) starts cutting rates, said a research report by State Bank of India.

The report estimates a staggering 74 million senior citizen term deposit accounts in India, holding a combined value of Rs 34 lakh crore. This represents a remarkable 81% increase in account numbers and a staggering 150% jump in total deposits compared to 2018.

"The increased in deposit rates, the higher interest rate differential for senior citizens and the special deposit schemes for senior citizens (for example WE-CARE by SBI) has propelled a tectonic shift in deposits accretion for citizens ably supported by also Government initiatives on SCSS, Mahila Samman Savings Certificate and so on," noted the report.

Exponential Growth in Senior Deposits

The report estimate suggests that there are around 74 million senior citizens term deposits accounts in the country with total deposit of Rs 34 lakh crore. Out of such 74 million accounts, almost 73 million accounts are in the size of up to Rs 15 lakh. By assuming 7.5% interest on Sr citizen bank deposits, Rs 2.6 lakh crore is the interest earned.

More From This Section

In 2018, SBI had estimated that there are around 41 million senior citizens term deposits accounts in the country with total deposit of Rs 14 lakh crore. So, in 6 years, there has been an increase of 81% growth in number of accounts and 150% in amounts.

"Interestingly, these 74 million accounts is a significant jump from that in FY19, when we had estimated that there were around 41 million senior citizens term deposits accounts in the country with total deposit of Rs 14 lakh crores. So, in a short span of 5 years, there has been an increase of 81% growth in number of accounts and 143% in amount in this cohort! The average balance in the accounts has grown handsomely by 38.7%, to Rs 4.6 lakh cr from earlier Rs 3.3 lakh crore, " said Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser State Bank of India.

In recognition of challenges faced by the senior citizen in sunset years with medical and other care needs growing exponentially as nuclearization of families gains velocity, the government has deftly ensured superior interest offerings through specialized schemes like SCSS as also card rates of banks having 50-75 bps markup for this segment.

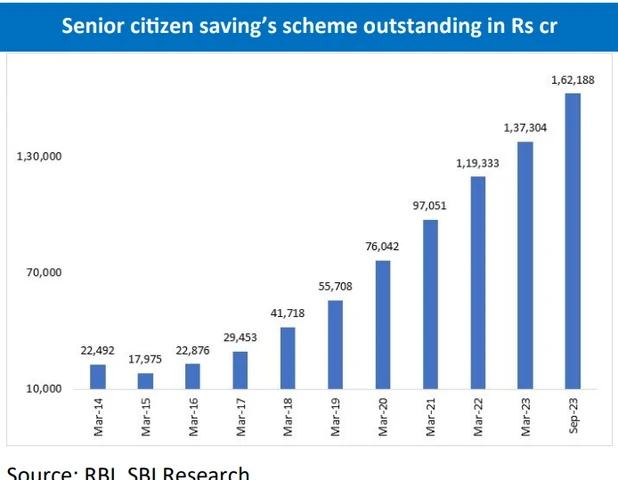

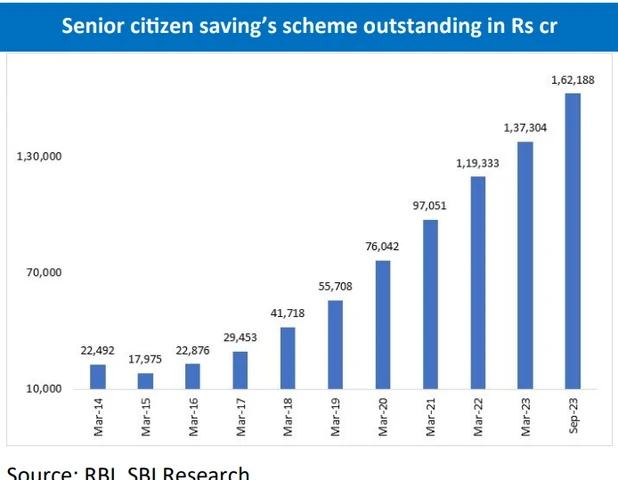

The Government of India's Senior Citizen Savings Scheme (SCSS) has emerged as a cornerstone of this financial upswing. Launched to safeguard senior income, SCSS allows deposits up to Rs 30 lakh with a guaranteed 5-year tenure and an attractive 8.2% interest rate. This, coupled with tax benefits and a secure investment environment, has proven immensely popular. The report reveals that SCSS outstanding deposits in H1 FY24 stand at Rs 1.62 lakh crore, a significant 89% increase since FY14.

Banks Sweeten the Deal with Special Senior Citizen Offerings

Commercial banks are also vying for a share of the senior savings pie by offering competitive rates. Many banks provide a 50 basis point (bps) premium over the standard card rate for senior citizens. Additionally, leading banks like SBI and HDFC have introduced special fixed deposit schemes with tenures tailored for seniors and interest rates 75 bps higher than regular rates. These initiatives, along with SBI Green Rupee Term Deposit's additional 100 bps for green initiatives, further incentivize senior savings.

The Power of Compounding: A Windfall of Interest Income

The report estimates that senior citizens earn a combined Rs 2.7 lakh crore in interest annually. This includes Rs 13,299 crore from SCSS and a significant Rs 2.5 lakh crore from regular bank deposits. Assuming an average 10% tax burden on this income, the government stands to gain approximately Rs 27,106 in taxes.

"It will be fair if such amount is given full tax rebate as the revenue foregone by the Government will not have impact on Government fiscal deficit," noted the report.

)

)

Atal Pension Yojana: Building a Secure Future

The government's Atal Pension Yojana (APY) is another key player in empowering senior citizens. Launched in 2015, APY aims to create a universal social security system, particularly for the underprivileged and unorganized sector workers. As of February 2024, the scheme boasts 5.46 crore subscribers and an impressive Rs 34,781 crore in assets under management (AUM). While the current scheme offers a maximum pension of Rs 5,000 per month, the report proposes raising this limit to Rs 10,000 to further enhance senior financial security.

)