The Nifty50 index on Monday breached the 20,000 mark for the first time as optimism around economic growth in India — seen as a major credible alternative to ailing China — prompted investors to increase their wager, even as valuation multiples entered the expensive territory.

Gaining for a seventh straight session, the Nifty50 hit an intraday high of 20,008, before ending at 19,996, up 176 points or 0.9 per cent. The 50-share index logged new highs on both intraday and closing bases, surpassing its previous highs on July 20.

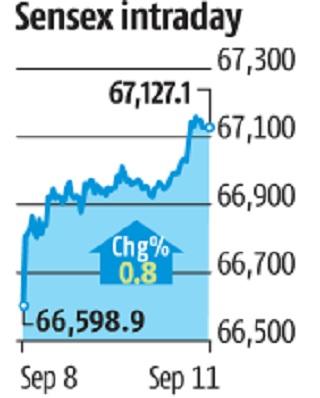

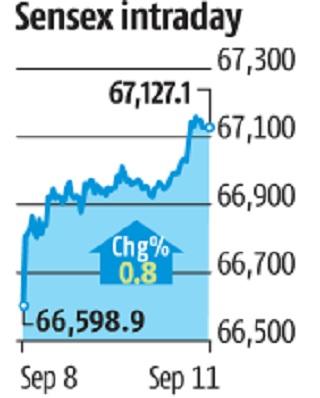

The 30-share Sensex, on the other hand, rose 528 points or 0.8 per cent to end at 67,127 — about 492, or 0.73 per cent, below its previous lifetime closing high of 67,619. The smallcap and midcap indices also hit fresh highs.

The market capitalisation of all BSE-listed companies hit a new record of Rs 324.3 trillion ($3.9 trillion). Total market capitalisation of NSE-listed companies was over Rs 321 trillion (nearly $3.8 trillion). From this year's lows in end-March, the Nifty50 has gained 18 per cent, while the Nifty Midcap 100 and the Nifty Smallcap 100 have soared 41 per cent and 49 per cent, respectively.

“There is limited global interest in Asia given the weak outlook for China, which has a very high weighting in the region. In India, there is a liquidity-driven rally, and investors should tread cautiously in the market as valuations are expensive now, with the Nifty50 trading at an FY25 price-to-earnings ratio of over 18 times, which is not cheap. Smallcaps and midcaps are even more expensive in many cases,” said Pratik Gupta, chief executive officer and co-head of Kotak Institutional Equities.

Gains in banking stocks and Reliance Industries (RIL) underpinned the gains on Monday. The Reserve Bank of India’s (RBI) move to discontinue the incremental cash reserve ratio (I-CRR) in a phased manner has triggered gains in banking stocks.

More From This Section

“Banking was one of the laggard sectors for the past few months, and it has a large weighting in the Nifty. Once that gets going, it lifts the rest of the market. The momentum is there, and it’s not just domestic buying but also foreign inflows,” said Andrew Holland, chief executive officer of Avendus Capital Alternate Strategies.

In a report last week, HSBC said India’s market is “like no other”, highlighting its ability to consistently outperform emerging and developed markets over the past two decades.

“Foreign investors view it as a large, liquid, domestically driven emerging market with a superior long-term growth outlook,” the note said.

On Monday, investors' sentiment was further boosted by improving Chinese data and comments from US Treasury Secretary Janet Yellen. During the weekend, Yellen said she hopes that the US reigns in its inflation without significantly damaging the job market.

The credit data from China showed signs of the economy stabilising after a sharp downturn. The data published on Monday showed that steps to bolster the real estate market gave a fillip to household demand for mortgages, and corporate loans have also begun to pick up.

The market breadth was positive, with 2,067 stocks advancing and 1,711 declining. Close to two-thirds of Sensex stocks gained. Reliance Industries rose 1.04 per cent and contributed the most to index gains, followed by HDFC Bank, which rose 0.5 per cent.

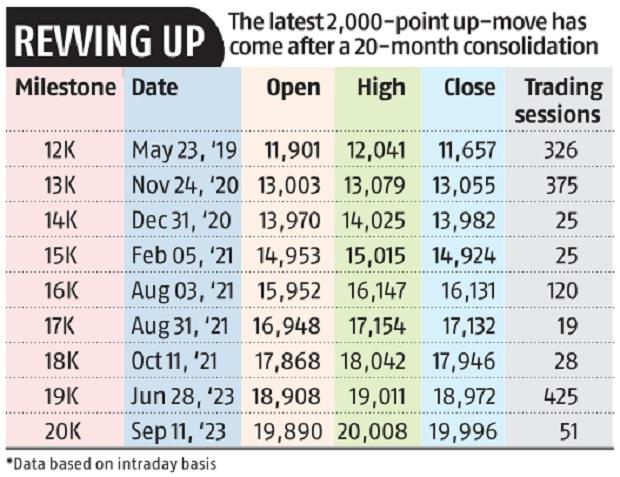

Latest 1,000 points' lap took 51 days

Latest 1,000 points' lap took 51 days

The Nifty50 went past the 20,000 mark intraday 51 trading sessions after it first crossed 19,000 on June 28. On July 20, the index came close to the milestone but then it witnessed a correction amid rising US bond yields. In the past seven trading sessions, the index has risen nearly 750 points, or 4 per cent, on optimism around India’s economic growth outlook.

(Samie Modak)

)