By Alex Gabriel Simon

India’s hospital stocks are set to benefit from the expected growth in healthcare spending, according to one of the country’s top-performing funds.

The country will witness a rapid acceleration in the number of people reaching retirement age in the next two decades, Satish Ramanathan, chief investment officer for equities at JM Financial Asset Management Ltd., said in an interview. “People will spend on healthcare at an unprecedented rate.”

Prime Minister Narendra Modi’s government recently approved expanding a free health-insurance plan for all citizens aged 70 and above. The plan may prompt some regional governments to introduce similar measures, providing a boost to the sector, according to Ramanathan, who oversees more than $1 billion.

)

)

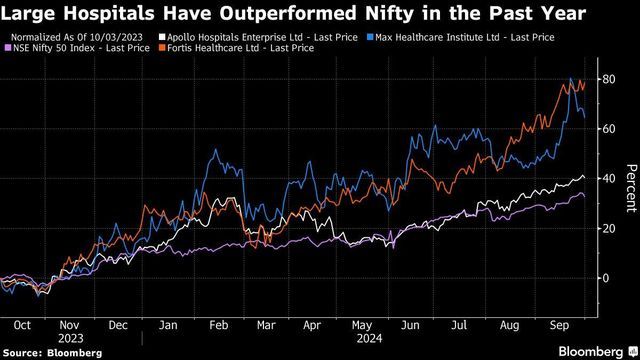

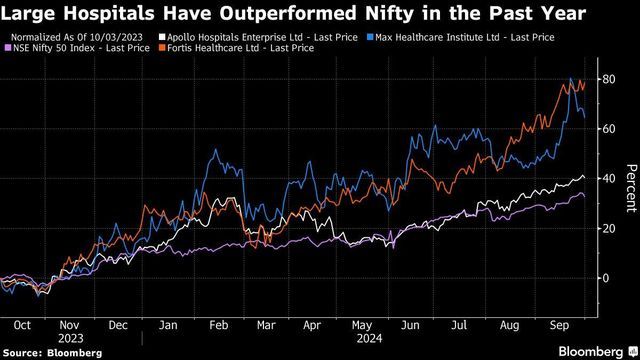

Some of the biggest players in the industry — Max Healthcare Institute Ltd. and Apollo Hospitals Enterprise Ltd. have gained 43 per cent and 26 per cent, respectively, in 2024. The momentum will likely continue as a widening insurance coverage provides hospitals another impetus to expand in a country that has just 1.3 hospital beds per 1,000 people.

More From This Section

“Currently India doesn’t have a safety net,” said Ramanathan. However, the government is becoming more cognizant of the situation and taking measures to tackle it, he added.

JM Flexicap Fund has returned over 40 per cent this year, beating over 96 per cent of peers during the period, according to data compiled by Bloomberg. It has been the best performer in its category over a three-year time frame, the data show.

Shares of ICICI Bank Ltd. and REC Ltd. — which are among the top-10 holdings — have gained 28 per cent and 34 per cent, respectively, in 2024. In comparison, the NSE Nifty 50 Index has gained about 19 per cent.

The fund held shares of Global Health Ltd., the operator of Medanta Hospitals, according to its most recent filing. The asset manager’s mid-cap fund held Fortis Healthcare Ltd. as of Aug. 31.

)