By Suvashree Ghosh

Wise Payments Ltd. plans to start signing up new customers in India for overseas remittances after a pause, seeking a bigger slice of a market that’s swelled to $32 billion.

The London-based fintech firm stopped accepting new clients in recent months in order to revamp its infrastructure after getting a license from the Reserve Bank of India that permits the app’s customers to send more money overseas. Wise plans to restart signing up new customers in the next few months, said Shrawan Saraogi, Asia Pacific head of expansion at Wise.

“India is a huge market for remittance,” Saraogi, 37, said in an interview with Bloomberg News. “We will be primarily focusing on cross-border movement that’s currently almost entirely done by banks.”

Major lenders like ICICI Bank Ltd. and State Bank of India have dominated the outbound remittance market in India thanks to strict capital controls, dated international payment rails and onerous taxes that have muted the impact of fintech rivals.

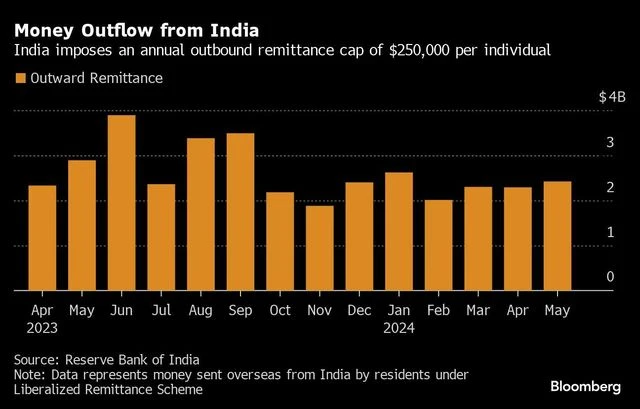

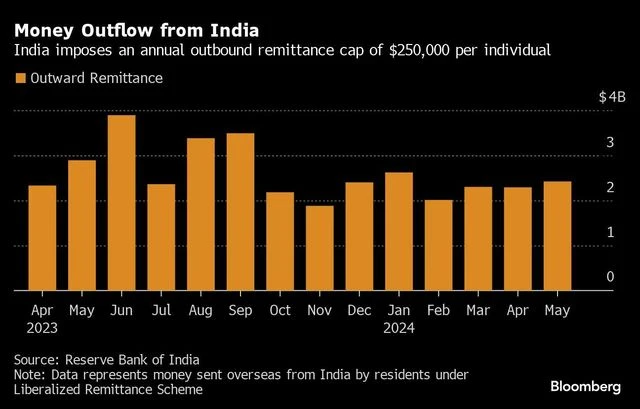

Indians remitted about $32 billion to other countries in the 12 months through to March 2024, up from $27 billion a year earlier, RBI data shows. Payments were made mostly for travel, education and family expenses.

)

)

More From This Section

Wise has offered outbound payments from India since 2020 via a bank tie-up — but the service was previously subject to a cap of up to $5,000 per transaction, which no longer applies, a spokesperson said.

Before accepting first-time users under the new regime, Wise is upgrading its back-end processes to comply with tax and reporting rules among other changes as required by the so-called Authorised Dealer 2 license, the spokesperson said. India imposes a 20 per cent levy on most outbound remittances by individuals.

Regulatory Friction

India’s market for retail digital payments is forecast to balloon to $7 trillion by 2030, according to a study by Kearney and Amazon Pay, up from just $300 billion in 2018. Digital transactions accounted for about 46 per cent of all payments in India in 2022, according to the government.

That’s partly why global fintech firms like Wise and Revolut are willing to jump through the many hoops required to do business in India. Revolut Ltd. received a Prepaid Payment Instruments license from the RBI in April, according to the firm’s spokesperson.

Firms must undertake “multiple rounds of securing licenses for every area” of digital banking products in India, said Charlie Short, head of growth in the Asia-Pacific region at Revolut, in an interview in May. The company has a waiting list of 200,000 users and hopes to launch its domestic and international payment tools in India soon, Short added.

APAC Growth

For London-based Wise, Asia-Pacific contributed about a fifth of its global revenue in the financial year ended March 2024, the second most after Europe excluding the UK.

Wise, which is present in nine markets in APAC, charges an average fee of 65 basis points globally, which is several times lower than banks in India.

“We think we can be a pretty meaningful player in that market because we will launch a product that will be fast, that will be cheap, that will be transparent,” Saraogi said.

)