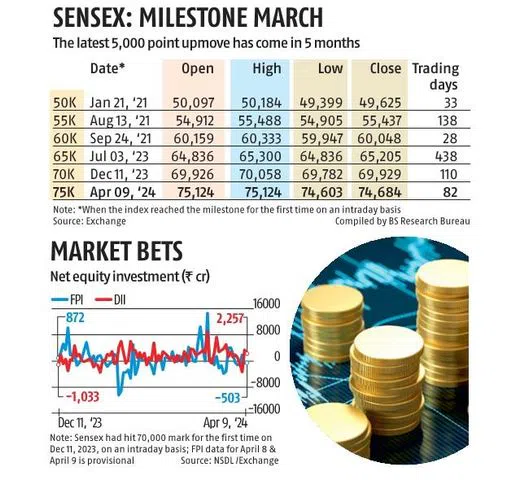

The BSE benchmark Sensex crossed the 75,000-mark for the first time in intraday trade on Tuesday but closed below this psychological level as traders booked profits, viewing recent gains as excessive. The index reached this milestone a day after the combined market capitalisation of BSE-listed companies crossed Rs 400 trillion.

The 30-share index hit an intraday high of 75,124, before ending the session at 74,684, down 59 points or 0.08 per cent. It first crossed the 70,000 mark on December 11, 2023.

The broader NSE Nifty 50 ended the session at 22,643, down 23 points or 0.1 per cent. After fluctuating between gains and losses, the Nifty Smallcap 100 index managed a 0.27 per cent gain — its 13th consecutive winning session.

Market sentiment was cautious ahead of Wednesday’s release of US consumer price data and Federal Reserve minutes, which should provide cues about the trajectory of the Fed’s rate hikes. Analysts described Tuesday’s profit booking — a common strategy where investors sell shares to book profits after a rise in stock prices — as a sign of consolidation before the Q4 results season. They also said the underlying trend is bullish due to a combination of earnings optimism and favourable macro data.

“The markets were expected to reach a new all-time high in the new financial year, but the pace of the up-move has been faster than anticipated,” said Naveen Kulkarni, chief investment officer, Axis Securities PMS.

)

)

More From This Section

“Going forward, the focus will shift to earnings delivery as stock prices are factoring in reasonable earnings season expectations. If the earnings season turns out to be disappointing, the markets will correct. However, if there are more upgrades than downgrades in earnings momentum, the markets will continue to move upwards. Nevertheless, the market may pause or consolidate before taking a direction based on earnings in the next 20 days.”

The Indian equity markets have been rising since December on hopes of rate cuts by the US Federal Reserve this year, continuity in government at the Centre and policy, and optimism about earnings and the economy.

The 10-year US bond yield retreated slightly but was trading close to its November 2023 high at 4.38 per cent. Investors will also be keenly tracking the European Central Bank’s monetary policy announcement, which would give clarity on earlier bets that it will start easing before the US Federal Reserve.

Brent crude was trading at $90.12 per barrel (until 8 pm IST) as investors assessed simmering tensions in the Middle East and supply concerns.

“Concerns have emerged amid recent better-than-anticipated US employment and manufacturing data, suggesting a potential shift in expectations regarding rate cuts this year,” said Vinod Nair, head of research of Geojit Financial Services. “Moreover, escalating geopolitical tensions in West Asia, alongside supply concerns, have propelled crude prices upward, impacting overall market sentiment.”

Overall, the market breadth was weak, with 2,288 stocks declining and 1,554 advancing. Close to two-thirds of Sensex stocks declined.

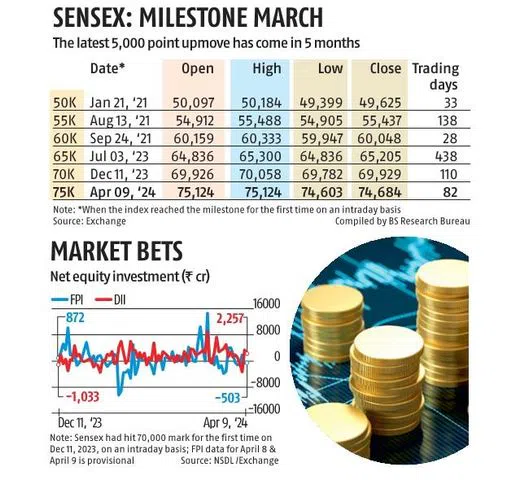

Foreign Portfolio Investors (FPI) were net sellers to the tune of Rs 593 crore, whereas domestic institutions bought shares worth Rs 2,257 crore. Leading contributors to Sensex gains were ICICI Bank and Infosys, while Reliance was the biggest drag.

)